Your OTA has thousands of hotel bookings a month in many locations. In its 2024 industry research, SiteMinder found a hotel website yields an average of $519 per booking in comparison with the other $320 per booking for OTAs. But let’s talk about the hidden cost that’s consuming your profit An unconfirmed booking mistake may effect a domino effect that wipes off an entire profit reports.

Now imagine that your customer rents a $400 oceanfront suite on your platform. They come full of enthusiasm for their trip, and it turns out their booking doesn’t exist. You’re left with a storm of negative reviews, an urgent rebooking at 150% surge rates, and a permanently lost user. This is not an uncommon situation and it’s taking place around the world every day with OTAs, and manual hotel booking reconfirmation processes are the biggest culprit.

Industry research by Phocuswire highlights a shocking fact that the majority of OTAs ignore almost a fifth of all hotel rooms booked online are cancelled before guests even arrive. But it gets worse for OTAs, in particular for the platforms under Booking Holdings have 50% of cancellation rates as direct booking which is only about 18.2%.

What does this say about your bottom line? Each manual hotel booking reconfirmation not only loses you the immediate booking, but it also potentially triggers a series of costly events that escalate throughout your business. You’re working on profit margins of 15-30% on commission, and those cancellations can turn a lucrative booking into very real losses.

It did not take long for Prague Residences to receive their wake-up call, one of which was the savings of $10,000 per month when they automated their hotel booking reconfirmation process and reduced their booking errors as well. Their result wasn’t anything revolutionary, but it did highlight how much their manual processes were actually costing them.

To understand why these fees are so steep, you have to look at the distinctive role that OTAs play in the booking ecosystem.Unlike airlines with a uniform PNR system or car rental with API confirmations, hotel bookings goes through multiple different systems. As an OTA, you find yourself in the middle of all this complexity, serving as the vital bridge between travelers and hotels through a range of various integration points.

The Integration Challenge: According to Kalibri Labs, only 29% of hotel reservations arrive directly at properties, with 23% coming through hotel websites and significant shares through OTAs like yours. These things combined have 3 operational implications

Here’s the competitive reality that makes this urgent: Automated systems can handle bookings 75 percent faster than manual processes can. While you are spending 8-12 minutes manually checking every booking that comes through, automated competitors are running that same verification in under a minute and on to the next sale. Location based attractions that manage their booking manually miss out on around 12% of potential bookings because their response times are slow.

It’s an exponential cost of complexity the moment you start understanding how the business models of OTA themselves work with commissions. Current commission levels tend to stand at around 15-30% of reservation value, with the global OTAs platforms of Booking Holdings suggesting commissions of between 15-17% and some regional OTAs rates peaking at 25-30%. But the actual economic effect of them is anything but these percentages.

When booking mistakes happen, they create several (at least two layers) of costs at the same time:

| Cost Component | Industry Reality | Your Financial Impact |

|---|---|---|

| Lost Commission | 15–30% per booking | $48–96 per $320 avg booking |

| Error Resolution | Manual intervention required | $80–160 additional per incident |

| Customer Acquisition | Replacement customer cost | $500–2000 per dissatisfied customer |

| Brand Reputation | Review and rating impact | Long-term booking volume decline |

The Multiplication Effect: An average-sized OTA processing 10,000 bookings per month with as little as a 2% error rate can end up with 200 failed bookings each month. At cost average resolution of $80 plus lost commissions for this, that is $24,000 a month lost to direct loss in revenue each month or $288,000 a year lost to preventable mistakes.

How your commission structure magnifies these costs is very much down to your business model. It’s becoming more and more common to see “hybrid” OTA models in the modern age, so understanding the differences helps make sense of why reconfirmation errors are such costly propositions.

Merchant Model Operations: In the merchant model, you are buying rooms at wholesale rate, and adding a markup before selling to the customer. This structure would make hotel booking reconfirmation errors even more costly, since you have already paid for the inventory and therefore increased your financial exposure. Room type switches affect directly your margins, and overbooking situations have immediate financial implications with Virtual Credit Card’s problems.

Agency Model Features: The agency model mitigates the degree of direct financial exposure, as guest payment occurs at the time of check-in, however, it creates other types of operational risks. Failed payments at check-in harm your platform reputation; commission disputes result from booking inconsistencies; and guest satisfaction directly affects your platform rating and, as a result, future booking volumes and competitive position.

Also, the complexity of this business model is a reason why the automatic hotel booking reconfirmation has become mandatory rather than optional. This requirement cannot simply be done by manual processes to manage the different risk profiles and operational requirements for different types of booking in same platform.

The performance difference between manual and automatic hotoel booking reconfirms systems has broadened significantly with the advanced technology. There are some metrics that industry data provides that can measure this operational disadvantage:

Evidence of scalability: A vacation rental company that leverages automation found the ability to handle 500% more properties without hiring more employees. Another mid-sized hotel chain also spent $25,000 in automation setup with $500 in monthly operating expenses serving 100 rooms, recouping their investment in four months from errors elimination alone.

Such performance discrepancy accumulates over time. Manual processes raise costs in a straight line against a growth in volume; automated systems can scale to booking volume at a relatively flat cost per booking, which completely transforms the economics of OTA operations.

The operational hurdles and expense we have described are customer experience problems, which entails brand risk across the long term. Accordingly, data from industry analysis indicates that 82% of travelers are booking their trips through travel websites or mobile applications, with 72% of travelers opting for online booking over physical travel agencies by 2023. When it takes hours for your manual validation to kick in, it’s a battle against everyone’s growing expectations of instantaneous validation.

The Service Recovery Challenge- Nearly 40% of hotel reservations are canceled prior to arrival; usually due to booking mistakes or not meeting guest expectations. If the discrepancies are not caught by your manual process, customers suffer long check-in waits, room-type mismatches, rate challenges or even complete booking failures. By the time manual processes catch the problem at most companies, the customers have already arrived and it’s too late for the elegant fix.

Long-term Competitive Impact: Travelers will book further in advance (average 32day booking window) but still expect instant confirmation. This difference between expectation and realization, together with the discrepancy of 50% VS 18.2% cancellation rate, leads to long term competitive disadvantages on the positioning of the product.

The customer experience connection is a part of the reason automation produces ROI beyond in operational costs savings: to protect and augment the customer relationships that support long-term business success.

The understanding of the cost and the customer impact clearly leads to successful implementation planning. The transition from manual to automated hotel booking reconfirmation has an established path that mirrors that from simple manual to automated to intelligent business logic.

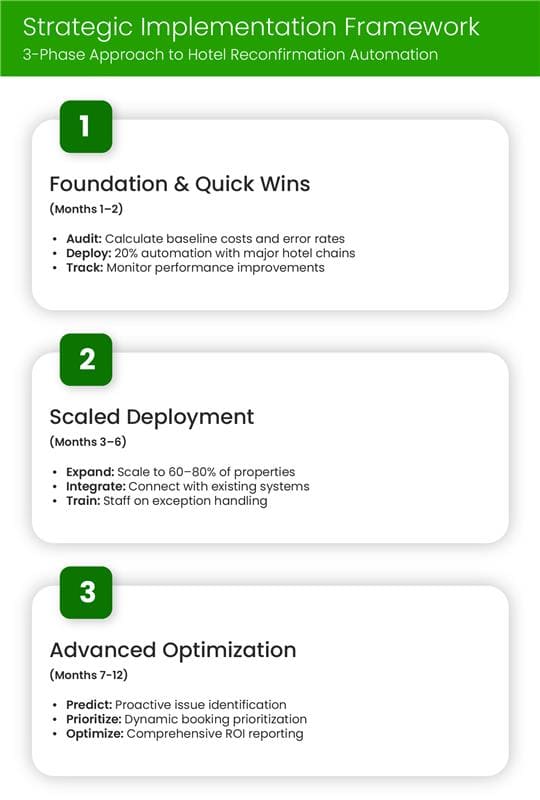

Phase 1: Foundation and Quick Wins (Months 1-2): Audit current manual processes and identify the ones that are highest-volume and standardized scenarios. Estimate costs on the basis of staff time, error rates and resolution. Automate 20% of the bookings concentrating on the major hotel chains having strong API integration. Set up parallel tracking to see performance uplift.

Phase 2: Expanded deployment period (months 3 through 6) :Expand automation to 60-80% on good candidate sites from phase 1. Hook into existing commission engines & revenue systems. Educate employees on exception management and system control, including establishing a broad performance monitoring regime.

Phase 3: Advanced Optimization (Months 7-12) implement predictive analytics and proactively identify issues. Assign dynamic confirmation priority according to the risk of booking. Set up an automated competitive intelligence and market monitoring tool, and work to develop comprehensive ROI reporting and optimization methodologies.

Vendor Selection Criteria: In considering which automation platform best fits your needs, prioritize OTAs with proven integrations, industry-specific knowledge, multi-channel sync-overs, real-time monitoring and alerting, and scalable architecture that supports your growth strategy.

The application framework must acknowledge the monetary investment and return. According to tracked industry performance, automation drives quantifiable ROI across four benefit streams:

Benefit Streams: Based on conservative industry benchmarks, anticipate 60-80% reduction in labor costs due to process automation, $200,000-$400,000 annually in savings from error resolution, 15-25% enhancement in booking accuracy, and 20-30% decrease in passenger losses from complaint-related outcomes.

ROI Time Line Analysis: 3,000-5,000% ROI year one is not uncommon among industry giants. Prague Residences’ $10,000 monthly ($120,000 annual) savings on a $200,000 investment = 60% ROI 1st year = and that’s just direct operational costs savings, not counting revenue protection.

At a mid-sized OTA processing 50,000 bookings per month, manual handling would cost between $150,000-200,000 per year, with error resolution costing $200,000-$300,000 per year. This results into total addressable costs of $350k-500k, which allows 6-12 month break-even with a good execution.

Context is added to the ROI analysis by considering the present market dynamics. The global online travel market was worth $523 billion in 2024 and estimates to hit $1.3 trillion in 2030, the market will growth 13.1% annually. In this growing yet formidable market, operational efficiency is your differentiator.

Market Reality Check: Ties between OTAs and Direct hotel bookings in 2025: $266 billion verses $262 billion. But share in the European OTA market grew from 19.7% to 29.6% 2013-2023, and the top four international OTA players invested a combined $17.8b on marketing in 2024, a further $1b beyond 2023. This increase in spend is reflective of increasing levels of competition where operational advantages are key.

The Automation Advantage: Industry research suggests that 80% of travelers shop an OTA before booking, even if they ultimately book elsewhere. This recurring behavior underscores it’s the confidence in booking and user experience that decides if you gain or lose these comparison shoppers. Not to mention that automation allows you to process 75% faster, manage 500% more volume without adding proportionate headcount, cut booking errors by 200%, and offer 24/7 booking confirmation unlike a manual process.

These operational benefits add up into a sustainable competitive positioning that manual-process rivals will find hard to shift.

All indications point to the adoption of automation but successful execution requires a careful and methodological approach:

Immediate Actions (This Month) Review current manual hotel booking reconfirmation costs, using metrics provided in this analysis. Identify your top 20% of bookings that are best for immediate automation. Ask for demos of established automation suppliers, who have OTA under their belts. Develop the business case within your organisation using the ROI calculator framework we’ve just given you.

30 DAY PLAN: Compile cost breakdown/analysis of existing manual processes, Mapping of integration points to your current systems, Choose vendor partner and finalize implementation schedule, Start staff training/prepare change management.

90-Day Success Outcomes: 75% Manual processing time reduction for automated bookings – 50% reduction in booking error rates – 20% increase in Customer Satisfaction Scores – Cost savings & error reduction will place project on positive ROI curve.

Manual hotel booking reconfirmation is a strategic gap that grows, not shrinks, over time. With industry-wide OTA cancellation rates at 50% compared to 18.2% direct cancellation rate and rivals smashing competitors with 500% capacity increases from volume automation, the operational efficiency divide is growing fast.

Prague Residences is saving $10,000 a month through automation, showing just how rapidly automation pays for itself and enhances service quality. According to industry leaders, there are first-year returns on investment from automation ranging from 3000-500% and manual processes impose scaling limitations that get more costly the larger you are.

The global online travel market estimated to be growing at $1.3 trillion by 2030, operational excellence is key in building sustainable, competitive advantage. The OTAs winning share of market are not the ones with the largest marketing budgets, they are the ones that provide the most sustainable booking experience through exceptional operational platforms.

The decision is clear: Invest in auto hotel booking reconfirmation solutions now, or lose market share as competitors deploy more efficient operations. The technology is there, the ROI is tested, and your customers are yearning for the consistent booking

Ready to take your hotel booking reconfirmation process to the next level? Begin by conducting a full audit of your current costs, and then rapidly pilot automated solutions with your highest volume hotel partners. Your decisions now are what will determine how competitive you are in the future.

Manual hotel booking reconfirmation is slow, error-prone, and not scalable. Each booking takes 8–12 minutes to verify manually, and staff often juggle hundreds of hotel extranets or inconsistent channel manager data. This leads to missed confirmations, double bookings, and incorrect room assignments directly impacting customer satisfaction and causing financial losses. Worse, these errors compound as your OTA grows, limiting your ability to scale profitably.

The financial hit is bigger than most realize. Even a 2% error rate on 10,000 bookings a month can result in 200 booking failures. With $80–$160 in resolution costs per incident and 15–30% commission loss, that’s $24,000+ monthly or $288,000+ annually in preventable losses. And this doesn’t include damage to brand reputation or customer churn.

Automation platforms integrate with APIs, extranets, and channel managers to verify bookings in real time within 30–45 seconds instead of minutes. They flag issues before customers arrive, auto-resolve common errors, and scale effortlessly. Some systems even prioritize high-risk bookings for proactive checks. This not only improves accuracy by 2–3x but also frees up staff to focus on exceptions rather than routine verifications.

Most OTAs recover their automation investment in under 12 months. Case in point: Prague Residences saved $10,000/month post-automation and achieved 60% ROI in the first year. On a larger scale, mid-sized OTAs processing 50,000 bookings/month can save up to $500,000/year by eliminating manual errors and associated costs. Additionally, automation improves booking accuracy by up to 25%, and customer satisfaction scores by over 20%.

Key criteria include:

Vendors that understand OTA operations and have experience with hybrid merchant/agency models are ideal.

Travel Automation Expert