In the travel business, it’s not always the flashy tech or sleek branding that keeps things moving it’s the people and systems behind the curtain.Especially your suppliers. If they fail, everything else starts to fall apart.

Take TravelPerk for example they’re not just dabbling in trips. They’re moving over 7 million journeys a year, all riding on their network of suppliers. And then you’ve got SAP Concur handling something close to $120 billion in business travel expenses. That’s not just operations; that’s orchestration on a massive scale.

And here’s the thing most travel companies? They’re realizing the cracks. Around 90% of executives in the industry are laser-focused on fixing how payments and finance flow. Why? Well, 66% of them are actually watching profits shrink because their supplier payment systems are, frankly, behind the times.

Want to hear something that really stings? Companies, on average, are waiting 40.3 days after invoice deadlines to get paid. That’s not a mild delay, that’s enough to mess with your cash flow, stall decisions, and create a domino effect across the business.

At the end of the day, managing supplier relationships in travel isn’t just a backend task, it’s a strategic game. One you can’t afford to play casually.

Running a travel operation isn’t like managing one or two vendors, it’s like juggling a full deck of players, all with different roles, expectations, and systems. Seriously, it’s not just flights and hotels; you’ve got dozens of moving parts, and they all need to play nicely together.

Airlines come first, obviously they’re the foundation of most travel plans. For example, American Express Global Business Travel handles more than $40 billion in flight bookings every year. That number alone shows how deep the airline-supplier connections go. It’s not just volume, it’s negotiated rates, inventory access, preferred treatment. Everything’s on the table.

Hotels? A whole different game. You’ve got big chains like Marriott and Hilton offering custom deals to corporate clients. Room categories, rates, perks it’s all pre-negotiated. But not every trip fits that mold, so operators also go through platforms like HRS or Hotelbeds to grab boutique properties or smaller, niche hotels. It adds variety and helps when major brands aren’t available or cost-effective.

Then there’s the transport layer. Traditional rental players like Avis or Hertz offer corporate programs with all the trimmings. But that’s changed a bit lately. Companies are also tapping into services like Uber for Business or Lyft’s business tier. They’re quick, mobile-first, and often easier to expense. It’s all about flexibility now.

And don’t forget activities. Travelers don’t just want to get there they want to do things. Platforms like Viator and GetYourGuide make it possible by linking into tour operators and local experience providers. On the other end, you’ve got insurance companies like Allianz and AXA covering all the “what-ifs” of travel. Without them? Risk multiplies.

Holding all this together is a layer of tech that doesn’t get enough credit. GDS systems Sabre, Amadeus, Travelport are the pipes running under everything, feeding data and pricing into booking tools. And for the money part? Processors like Adyen, Stripe, or Trust My Travel take care of payments. Especially the cross-border, multi-currency stuff that gets real messy, real fast.

So yeah, when people say “supplier network,” they don’t always get the scope. But this? This is the real picture. Messy, diverse, and completely essential.

If there’s one thing people underestimate in travel operations, it’s just how many moving parts are constantly in play. Supplier relationships aren’t just handled through contracts, they’re managed minute by minute, click by click.

Inventory management is the first monster to tackle. You’ve got to sync pricing and availability across a ridiculous number of suppliers in real time. When someone searches for a flight on a corporate platform, that system is basically running around behind the scenes pinging airline reservation systems through GDS channels, sorting through pricing, applying corporate discounts, and then filtering it all based on company rules. It all happens in seconds, but behind that speed? A lot of technical juggling.

Then come the contracts. This isn’t retail travel contracts are layered. Airlines offer volume-based discounts, net fares, even commissions, depending on what kind of deal you’ve struck. Hotels work differently. You’re talking about fixed corporate rates, preferred room types, sometimes perks like breakfast or late checkout bundled in. And all of this shifts depending on seasons, booking patterns, and supply.

Now payments… that’s where things get even trickier. Look at Airbnb they’re handling payments in more than 60 currencies. Meanwhile, traditional travel management companies are dealing with payments across virtual cards, ACH transfers, and international wire systems. And the fun doesn’t stop there reconciliation is another beast. You’ve got cancellations, changes, partial refunds all of it needs to be matched correctly across multiple suppliers in a single trip. And yes, that often takes days, not hours.

The whole system? It’s one big web. And travel operations need to keep it all tight, synchronized, and responsive. One break in the chain, and the experience falls apart.

Technology is the glue holding everything together in travel operations without it, managing supplier relationships would be chaos. These days, APIs are doing most of the heavy lifting. They’re not all built the same either. Each supplier has its own way of connecting different formats, security protocols, the whole nine yards. So every integration becomes its own little project.

Take TravelPerk, for example. They’re working with over 800 live API connections. That’s not an exaggeration. Meanwhile, Booking.com for Business has integrations with 250+ suppliers across categories like hotels, ground transport, even insurance. It’s a lot to keep in sync.

At the heart of all this sits the booking engine. That system is the real workhorse. It’s handling authentication for every supplier, pulling in inventory, processing bookings, pushing payments all at once. And it has to be tough enough to deal with hiccups too. Sometimes a supplier times out, sometimes their system hits a limit your engine has to know how to wait, retry, or reroute. Smooth on the outside, but complex underneath.

Then there’s data mapping. Sounds boring, but it’s one of the hardest parts. Every supplier describes things their own way. One might list a room as “Standard Queen,” another says “Queen Bed – Standard.” Multiply that inconsistency by hundreds of suppliers and thousands of listings, and you’ve got a serious headache. Travel operations have to clean that up behind the scenes, making sure everything appears consistent for the user while keeping the original details intact for bookings.

And let’s not forget about caching. That’s a big deal too. Suppliers often charge for API calls or limit how many you can make. So companies build smart systems that save frequently requested data but not for too long, or it gets stale. Expedia’s a master at this. Their caching setup handles billions of daily requests while still keeping data fresh. That’s not easy to pull off.

All this tech work? It’s not optional. If you want real-time, accurate, and reliable bookings, your infrastructure has to be rock solid.

Money in the travel industry doesn’t move in straight lines. It’s complicated, sometimes even messy. You’ve got payments that go out before a trip starts, others that are billed after, and some that hit the account the moment a booking is confirmed. It’s a balancing act. And for operations teams, managing all that can be a real grind.

Many travel companies actually front the payment to suppliers before they ever get paid by clients. That creates a cash gap, and when you’re talking large volumes, it can get tight fast. Working capital gets tied up, and if you’re not watching your books closely, things can spiral.

Add to that the currency puzzle. One business trip might include airfare priced in dollars, a hotel bill in euros, and a car rental in yen. It’s not just about converting it’s about managing the risk that comes with exchange rates shifting between the time of booking and the time of payment. Firms like CWT handle payments in 150+ currencies, and doing that well takes serious infrastructure.

And then there’s reconciliation. You’ve got last-minute changes, no-shows, canceled bookings, partial refunds it all messes with the numbers. Let’s say a traveler switches their hotel two days before arrival. Someone has to talk to the hotel, adjust the cost, update the booking, maybe cancel a payment authorization… and that’s just one leg of one trip. Multiply that by hundreds or thousands a week, and you’ll see why finance teams stay busy.

Virtual credit cards have become a game changer. Companies like Navan issue a unique card per booking. That way, it’s easier to track spending, control who can charge what, and simplify the mess of matching payments to bookings later on. These cards often have built-in controls merchant limits, spend caps, expiration dates tied to trip length. They’re smart tools for a system that doesn’t have a lot of room for error.

Bottom line: travel payments are far from straightforward. And if you’re not careful with how you handle them, you could end up burning through time, money, or worse trust.

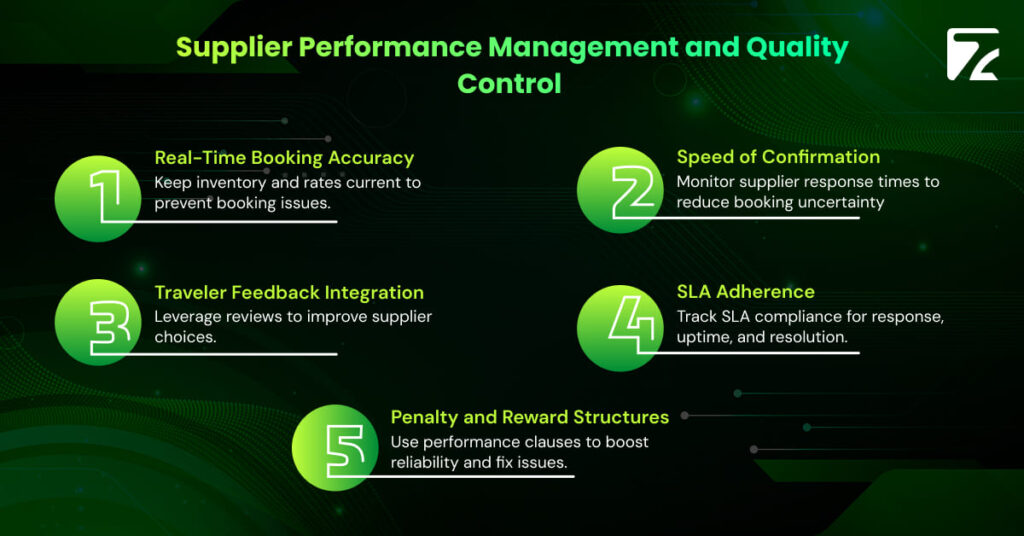

In travel operations, it’s not enough to just have suppliers you need to know how well they’re actually performing. It’s a constant process of watching, measuring, and adjusting. Because when something goes wrong for the traveler, nine times out of ten, it’s tied to a supplier slip-up.

Operations teams usually have a set of metrics they track closely. For example, how fast a supplier confirms a booking. Airlines typically nail it within seconds it’s automated. But hotels? That’s hit or miss. Some are quick, others take hours, especially when it involves special requests or smaller properties.

Accuracy’s another big one. If a supplier lists the wrong room type, or doesn’t update availability in time, it can throw the whole trip off. So operations folks keep a close eye on how often those kinds of issues come up.

Then there’s traveler feedback. After every trip, companies often collect ratings sometimes as simple as a thumbs up or down, other times full surveys. If a particular hotel keeps getting bad marks, that starts a conversation. Do we renegotiate terms? Do we drop them from our preferred list? That kind of decision is data-driven, but it’s also based on trust.

SLAs (Service Level Agreements) are the backbone here. These set the bar for performance. Things like how fast bookings must be confirmed, or how often the API needs to be up and running. If a supplier falls short, there might be penalties. Or, on the flip side, rewards for consistently good service.

Diversity is also coming into play more now. Many clients are asking their travel providers to include suppliers from underrepresented communities minority-owned hotels, women-led car services, that kind of thing. It’s not just about compliance it’s about reflecting the values of the companies using these services.

In the end, it’s about keeping quality high across the board. Because if you don’t manage your suppliers well, the traveler’s experience suffers and that reflects directly on you.

Travel operations encounter numerous supplier-related challenges that require immediate resolution. Overbooking situations arise when hotels or airlines sell more inventory than they have available. Travel operations must have protocols for rebooking affected travelers, negotiating comparable accommodations, and managing additional costs.

Technical failures represent constant operational risks. When a major supplier’s booking system goes offline, travel operations must quickly shift to alternative suppliers or booking channels. This requires maintaining relationships with backup suppliers and having technical systems capable of rerouting bookings automatically.

Supplier bankruptcy or sudden closure creates immediate operational crises. When Thomas Cook ceased operations in 2019, travel operations worldwide had to rapidly re-accommodate thousands of bookings and navigate complex refund processes. Having contractual protections, insurance coverage, and alternative supplier arrangements becomes crucial for business continuity.

Communication challenges arise from working with suppliers across different time zones, languages, and business cultures. A travel operation managing global corporate accounts might need to coordinate with hotel suppliers in Tokyo, airline partners in London, and ground transportation providers in São Paulo simultaneously.

Travel companies don’t just deal with bookings they’re constantly navigating a thick layer of rules that directly affect how they work with suppliers. And yeah, skipping this part? It can seriously backfire.

Let’s start with GDPR. Anytime traveler data gets passed along to suppliers especially in or across Europe you’ve got to make sure those partners know how to handle it. That means following data protection laws to the letter, with proper agreements in place that lay out exactly how the data should be processed.

Now switch over to financial regulations. These don’t look the same everywhere. Depending on the country, there are different hoops to jump through. AML (anti-money laundering) rules? They demand you vet your suppliers properly and keep an eye out for anything shady in the transactions. On top of that, some places limit how currency exchanges work or require all kinds of documentation before payments even go through internationally.

If your business is in the game of issuing airline tickets, you’ll run into IATA rules too. Those include financial requirements, specific settlement methods, and very strict standards when it comes to reporting to airline suppliers. It’s not optional you follow or you’re out.

Then there’s consumer protection. In the EU, for instance, you’ve got the Package Travel Directive. It says that companies must provide financial protection for travelers’ bookings. That regulation affects the way supplier contracts are written and how payments are structured. You can’t get around it you build it in or risk falling out of compliance.

Bottom line? Regulations like these aren’t just red tape they shape the foundation of how supplier relationships work in travel. If you ignore them or cut corners, you’re not just gambling with operations you’re risking the whole show.

In travel, it’s not about if a crisis hits it’s about when. And when it does, supplier relationships get put to the test fast. Whether it’s a weather disaster, a tech crash, or a political shutdown, travel operations need a plan to keep things moving.

Natural disasters are a common threat. They can knock out local suppliers in a flash. When that happens, travel teams need to act quickly switching out unavailable partners, finding new accommodations, and making sure travelers aren’t stranded. That only works if you’ve already lined up backup options.

Then there are health crises. The COVID-19 pandemic showed just how fragile the supply chain in travel really is. Cancellations came in waves. Rebookings were nonstop. The only companies that handled it well? They had flexible contracts, good communication with suppliers, and systems that could adjust on the fly.

Politics can throw a wrench in things too. A new travel ban or sudden instability in a region can cut off access to key suppliers. To stay prepared, travel ops teams usually build contingency plans that include alternate suppliers and communication protocols for these exact moments.

Money troubles on the supplier’s side are another concern.If a partner looks unstable financially, it can lead to big problems down the line.That’s why a lot of travel firms monitor their suppliers’ financial health, using credit checks or watching industry signals. If a partner starts showing signs of distress, companies want time to act before things fall apart.

In short, it’s about staying one step ahead. Crisis management and business continuity aren’t just add-ons they’re core parts of supplier strategy in travel.

Working with travel suppliers? It’s not just about signing a deal and moving on. These contracts? They’re layered. You’re dealing with shifting demand, peak seasons, and service expectations that can change overnight.

For corporate travel, it gets even more detailed. You’re not just setting prices you’re setting targets. Spend thresholds, service levels, commitment periods it all goes in. The fine print really does matter.

When it’s time to talk rates, each supplier brings their own playbook. Airlines usually base pricing on how much you book with them across the year more volume, better deal. Hotels, though, might just knock a percentage off their standard rates, or offer a flat corporate rate for certain room categories. It all depends on patterns how, when, and where you book.

Now, preferred supplier programs are a whole different layer. These are give-and-take deals. You agree to direct more business their way, and in return, they offer things like upgrades, later checkouts, or even better support lines. But you lose some freedom. So, ops teams have to ask is the consistency worth giving up the flexibility?

And here’s the thing when these relationships stick around long enough, they evolve. It’s no longer just about the next booking. You start planning together, looking at market trends, maybe working on tech improvements side by side. That doesn’t happen with every supplier. It happens when there’s mutual trust and regular check-ins.

That trust? You earn it. Not with paperwork but by showing up, following through, and being fair when stuff hits the fan.

Managing relationships with suppliers in the travel world? It’s not something you can just wing. You’ve got to really understand how the industry ticks, what tech tools are doing behind the scenes, and how all the moving parts connect. The companies that do well? They’ve got systems that are tight, payment processes that don’t leave them exposed, and supplier partnerships that can handle the rough patches.

The truth is, for top-performing travel operations, this isn’t a side task. Managing suppliers is right at the center of their business. It’s what helps them deliver consistent service and stay ahead of the pack. They invest in this technology, processes, people all aimed at building a network of suppliers that makes them stronger. Better prices, smoother service, fewer surprises.

And the thing is, the travel space isn’t standing still. There’s always a new tool, a new kind of traveler expectation, or global disruption coming down the line. The teams that come out on top? They’re the ones that get how to balance things tight partnerships without losing agility, smart tech without forgetting the people side, and cost control that doesn’t sacrifice quality

It’s the process of building strategic, long-term partnerships with suppliers like airlines, hotels, and transport providers to ensure seamless service delivery and mutual business growth.

Because a single supplier slip-up can disrupt an entire travel experience. Strong relationships lead to better rates, faster resolutions, and more reliable service.

By setting clear SLAs, tracking key metrics like response time and booking accuracy, and holding regular review meetings to align on goals and improvements.

They often struggle with system incompatibility, inconsistent data formats, delayed payments, and the need for real-time coordination across time zones and currencies.

Tech tools like APIs, booking engines, and payment processors help automate, sync, and standardize interactions, reducing manual work and boosting accuracy.

Travel Automation Expert