TL; DR Summary Travel portal is an online booking solution that matches the travel services with the buyer. B2B portal caters to travel agent and sub-agents on wholesale pricing, B2C portal targets at the end traveler directly with consumer smart UI, while B2B2C portal caters to both in one platform. Travel agencies can make use of this guide to identify the appropriate portal model as per their business strategy, growth objectives, and target market segments.

Travel portals are websites that provide travel services such as flights, hotels, car rentals, tours and vacation packages and are designed by travel companies for searching, comparing and booking travel services through a common online channel. It’s the underlying tech driving travel bookings for consumer travelers, travel agents, and corporate travelers.

In 2026, not having a strong travel portal comes with the largest opportunity cost for travel agencies. Q1 2025, 72% of all travel bookings across the globe were completed online, with current figures predicting they will reach 75% by 2029. The global online travel market, which was worth $654 billion in 2024, is projected to exceed $1.26 trillion by 2032 at a CAGR of 12.99%.

But not all travel portals are created equal. Now, the three core models B2B (Business-to-Business), B2C (Business-to-Consumer), and B2B2C (Business-to-Business-to-Consumer) are there to serve distinct functions. The wrong model leads to unused capability, inefficiency in operations, and lost revenue. Learning which aligns with your agency’s strategy is crucial to getting the most from your investment in travel technology.

A B2B travel portal is an online booking system for organizations to offer travel services to other businesses. B2B portals are used by travel agencies, tour operators, DMCs and consolidators to give their sub-agents, corporate clients and reseller networks access to their booking. B2B portals are functional, not pretty (unlike consumer facing platforms) built for bulk bookings, operations, complex price structures, etc.

Multi-User Role Management: B2B portals allow for a level of user access that is more complex and hierarchical. A master agency can create sub-agent login credentials, set permission levels, and manage access to inventory. E.g. an agency in Mumbai could have 50 sub-agents (all around India) with tailored commission rates for each agency along with access to their combined inbox for communication management.

Markup and Commission Engine: Agencies keep different profit margins for different sub-agents. You set variable markups 15% for premium agents, 10% for high-volume Agents on all hotel inventory you purchase at net rates.

Wholesale Pricing Access: B2B portals can be integrated with GDS systems (Amadeus, Sabre, Travelport) and 3rd party APIs to expose wholesale rates not available for the consumer. Corporate bookings handled through B2B systems typically yield 22 percent more savings than those made through B2C channels, according to Amadeus research.

Credit-Based Booking: It is a unique proposition where many B2B portals allow sub-agents to book now and pay later either on a weekly or fortnightly basis, thus eliminating the booking friction and increasing operational efficiency.

White-Label Capabilities: Sub-agents can rebrand the interface with their logo, colors and domain while using the consolidator’s infrastructure, just like white-label travel solutions work across the industry.

A B2C travel portal allows an individual traveler to search, compare and book travel services directly online. Such consumer-facing platforms focus on user experience with their rich imagery, user reviews, tailored recommendations, and immediate booking confirmation. End travelers are being attracted, engaged, and converted via emotional engagement & brand building.

Consumer-Centric Design: B2C portals spend a significant amount of time creating a visually appealing site along with easy-to-navigate layouts while utilizing high resolution images, video, and ensuring a mobile shopping experience. With 83% of travelers researching trips on mobile and 45% of all online bookings made via mobile in Q1 2025 (and those numbers are almost certainly higher today), a mobile–first design approach is needed.

Dynamic Pricing and Personalization: AI-powered algorithms showed hyper-personalized recommendations based on browsing patterns and historical bookings. By Travelport Digital, 82% of travelers value personalization in a B2C booking channel.

Social Proof Integration: Customer reviews, ratings, traveler images, and social media content that builds authority. In 2023, 75% of travelers say what they saw on social media posts made them choose to travel to the destinations they did. Review management systems are critical for B2C.

Marketing Investment Required: B2C portals need to invest in SEO, pay per click campaigns, content marketing and social media campaigns to bring traffic. Understanding SEO for travel agencies becomes non-negotiable.

Multiple Payment Gateways: Integration with credit/debit cards, digital wallets, UPI (Unified Payments Interface), and buy-now-pay-later services address global payment preferences by supporting multiple gateways.

B2C portals that is well-placed for OTAs going up against Booking com or Expedia, niche travel business that focus on luxury or adventure tourism, hotels that want to sell directly instead of outsourcing their rooms to OTAs, and tour operators who have special experiences to offer.

A B2B2C travel portal is an integrated platform that essentially combines the functionalities of a B2B portal and a B2C portal. Agencies can now play both sides by doing B2B wholesale sub-agent bookings with B2C direct bookings from end consumers to their brand.

Scenario: A travel agency in Delhi has a B2B2C model, with 100 sub-agents in tier-2 cities booking at wholesale rates with markups, while consumers only book directly on the consumer-facing website at retail rates. They both run from the same inventory, shared APIs, and centralized booking management platforms.

Dual Revenue Streams: Not dependent on one acquisition channel. A slow-growth sub-agent network complements direct B2C bookings.

Market Expansion: Sub-agents expand geographical footprint while B2C builds urban brand awareness through digital marketing strategies.

Operational Efficiency: One platform is more cost-effective than separate B2B and B2C systems with unified reporting and inventory management.

Strategic Flexibility: Focus on the higher-performing channel without the need to rebuild infrastructure.

B2B2C portals are ideal for expanding agencies that want both an agent network and direct bookings, regional companies interested in balancing local relationships with online sales, tour operators that provide to both trade partners and consumers, and startups that want to test either model without full commitment.

Agency used to be conducted via phone calls, faxes and forms before digital portals. Yearly, online travel bookings are 148.3 million. The automated portals support these round the clock without the human efforts thus diverting the staff for complex itineraries and relationship handling.

Hotels and operators lose a lot of money through no-shows. Today, portals have built-in automated booking confirmation systems with AI-driven communication through SMS, email,and WhatsApp. Using guest messaging automation, there are easy ways to utilize automated confirmation workflows that can reduce no-show rates by up to 23% within a 90-day period.

Travel portals use a PCI-DSS payment gateway that encrypts financial data with compliant standards and enables payments via different payment methods. The emerging technology for transparency in payment and verification of payment is based on blockchain technology. The AI travel market sits at around $1.2 billion by the end of 2026, of which 70% of companies will apply AI to optimizing prices and detecting fraud, and find forecast accuracy improving by 40%

Small Agencies (1-5 staff): B2C or relatively simple B2B2C portals, focused on direct bookings / penetration of local market

Medium Agencies (6-25 staff): B2B2C portals offering balance between agent partnerships and direct consumer acquisition.

Large Agencies (25+ staff, multiple branches): B2B portals with strong multi-branch management, credit systems, and sophisticated reporting.

Agent Network Expansion: Focus on B2B with good white label & multi-level commissions capabilities.

Brand Building for Direct Sales: B2C portals with best-of UX, content marketing tool stack, and SEO functionalities

Hybrid Approach: B2B2C portals provide strategic flexibility without separate system costs.

The value of your portal is determined by access to inventory via GDS (Amadeus, Sabre, Travelport) both for airlines and global hotels, third-party API (Expedia,Booking.com, Hotelbeds) for competitive rates, direct contracts for negotiated rates and LCC connections for budget airlines. Diverse inventory sources create competitive pricing critical for both B2B agent satisfaction and B2C consumer conversion.

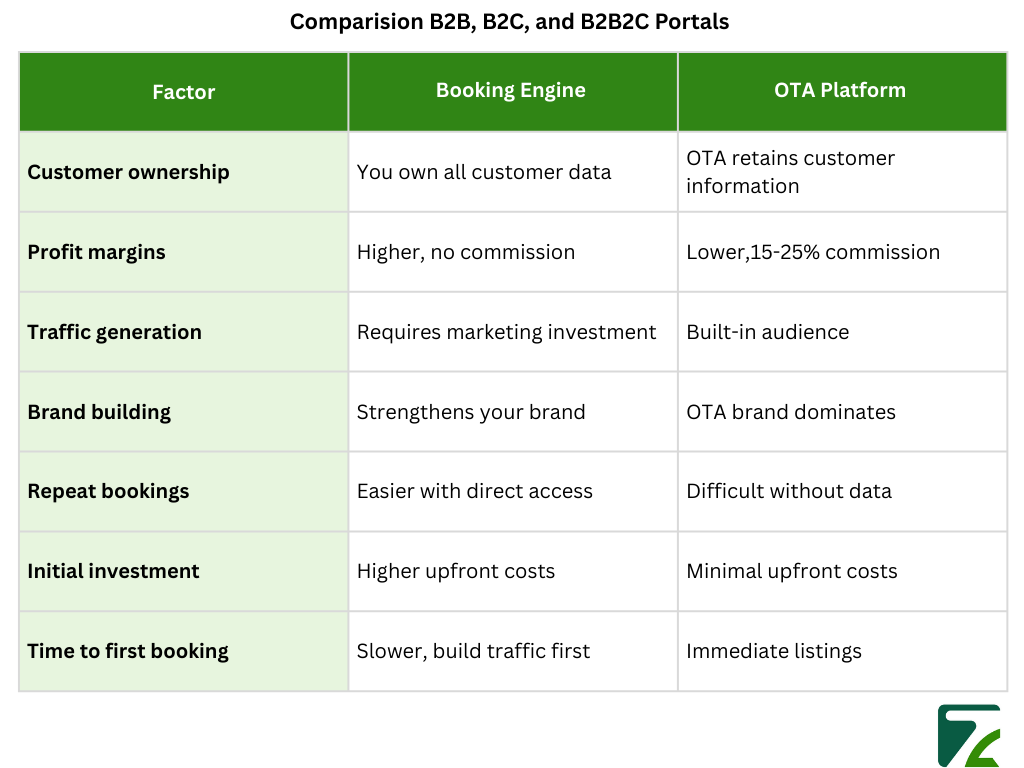

The travel portal you opt for makes your agency work more efficient, grow rapidly and stands out among competitors. For wholesale distribution and agent networks, B2B portals are best. Direct consumer relationships and brand building can be done with B2C portals. And the appeal of B2B2C is that it leverages aspects from both models and provides a hybrid approach for the right strategic flexibility.

With 75% of travel revenue projected from online sales by 2029, those agencies that have a digital transformation strategy delayed will be left behind. Evaluate your present and future revenue sources. Focus on B2B if agent networks are the reason for business. If direct-to-consumer bookings are critical to your future, invest in B2C. B2B2C offers flexibility to succeed in both channels if building a hybrid model or unsure.

Keep in mind, your portal is only as good as the operations that sit behind it. Utilize booking automation best practices, set up strong confirmation workflows, spend money on employee training, and optimize continuously based on performance data. The portal is your base operational excellence that builds success on top of it.

White-label solutions range from $5,000-$50,000 for initial setup with $500-$5,000 monthly fees. Custom-built portals cost $50,000-$150,000+ depending on complexity and GDS integrations. White-label solutions offer better ROI and faster deployment for most agencies.

B2B portals need minimal digital marketing focusing on relationship building through direct outreach and trade shows. B2C portals demand continuous SEO, PPC, content marketing, and social media investment to drive traffic. B2B2C portals need moderate marketing across both channels.

B2B portals show ROI within 6-12 months as agent networks build. B2C portals take 12-24 months due to traffic building and brand recognition needs. B2B2C portals achieve breakeven within 12-18 months. Companies adopting online reservation systems see an average 20% increase in bookings.

Small agencies shouldn't compete on inventory breadth or technology spending. Focus on niche markets, personalized service, local expertise, and specialized destinations where OTAs provide generic experiences. Your competitive advantage comes from relationship-building, curated experiences, and market specialization.

A booking engine is the core search and reservation component. A travel portal is the complete ecosystem including booking engine, user management, payment processing, reporting, CRM integration, and supplier connections. The booking engine is the engine; the portal is the complete vehicle.

Travel Automation Expert