The travel tech ecosystem is about to be disrupted, in a big way. Though generic software platforms have historically ruled the business landscape, vertical SaaS niche solutions designed specifically for travel is proving to be a better alternative. This change is a strategic transition that amounts to tangible business results.

The size of the global travel technology market was valued at USD 10.7 billion in 2024, and it is anticipated to reach USD 18.6 billion by 2033 with a CAGR of 6.05%, as stated by IMARC Group. Within this surge, vertical SaaS solutions catering to travel operations are gaining a greater share of the market and reshaping how OTAs, agencies and tour operators view technology investment.

Vertical SaaS is software that’s purpose-built for one particular industry. In travel, this looks like platforms that are built only for booking management, supplier relationships, commission tracking, voucher generation, and itinerary coordination. These systems know travel language, compliance intricacies, and operational details on their own, without any customization needed to use them effectively.

On the other end of the spectrum, there is Horizontal SaaS, which offers broad solutions that can apply to any business in any vertical. Examples of such solutions include general CRM systems, project management tools, or accounting software. While these platforms serve a wide range of needs, however, also need substantial customization to cater to travel-oriented requirements such as OTA commission models, multi-currency and seasonal price trends.

The difference is significant because operations in travel are the workflows that do not exist anywhere else. The management of OTA Bookings is much different than the handling of sales leads as in the manufacturing company. Hotel confirmation protocols have no equivalent in retail. The commission structures, the seasonal-demand patterns and the supplier-relationship complexities entail operational needs for which generic software was not made.

The worldwide vertical SaaS market, as estimated by Business Research Insights, was $106.05 billion as of 2024 and the sector is growing at a CAGR of 16.3%, which is much faster than horizontal SaaS growth figures. This growth is indicative of companies from every sector understanding that tailor-made services produce a superior result than adapting the generic version.

Generic software must be highly customized in order to accommodate travel workflows. An OTA provider offering horizontal CRM needs to custom code for booking references, voucher numbers, confirmation status of the reservation, commission rates, details of the supplier and payment terms. Each customization entails weeks or months of development time, training staff on custom processes, continued maintenance when the software is updated, and additional consulting fees for modification.

Based on a report by Finro Financial Consulting, firms that employ horizontal SaaS allocate between 40-50% of their technology budgets to integration and customization, rather than towards operational enhancements. For a mid-size travel agency with a ₹40,000 monthly software budget, that’s already ₹16,000-20,000 being spent each month by the cost to just keep things running rather than growing your business. A proposition which also structurally won’t bear the cost for many travel MSMEs already undergoing margin compression due to OTA commissions, suppliers’ cost inflation and a labor shortage.

Travel companies run several different kinds of systems concurrently: booking engines, accounting software, customer databases, supplier portals, and communication systems. Generic platforms don’t integrate natively with travel systems ,so they become data silos.

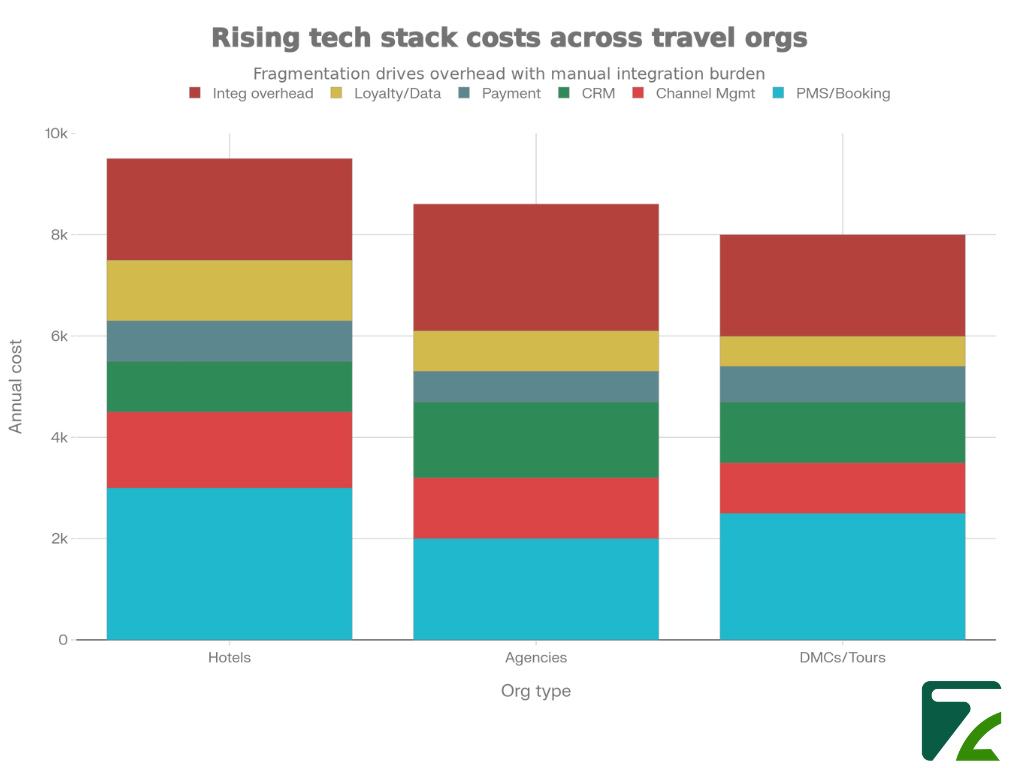

Figure 1: Rising tech stack costs across travel organizations

Overhead due to manual integration of encumbers with regards to fragmentation. Hotels are hit with yearly commitment close to $9,500, agencies $8,500 and DMCs $8,000, with integration being the biggest cost category.

A travel agency that handles 500 bookings a month on the other hand spends 15-20 staff hours manually transferring data every week, which comes out to ₹60,000-80,000 in annual labour cost that vertical SaaS does away with.

Vertical SaaS platforms come pre-configured with travel operations natively embedded. Revenue management systems automatically adjust pricing according to booking trends, predict demand in real-time, track the competition rates, and even understand seasonality features that are impossible to replicate without significant customization.

Generic Software Timeline:

Vertical SaaS Timeline:

Travel agencies that adopt vertical SaaS experience 90% faster deployment and a 50% reduction in training costs than with horizontal systems, First Page Sage said.

OTAs and agencies oversee distribution across a wide range of pathways, from direct-bookings to OTA partnerships of which Booking. com site and Expedia, GDSs, and supplier portals. Vertical channel management systems will also automatically synchronize availability across your channels, stop double booking by updating all inventory in real-time, manage rate parity between booking channels and allow you to monitor which source of business is driving profitability, alongside automating commission handling based on channel. Generic software requires manual processes or expensive custom integrations to achieve comparable functionality.

Travel agencies manage customer queries that are time-critical with the necessity to provide direct access to booking info, payment status, supplier confirmations, and itinerary information. Vertical platforms deliver consolidated histories for full booking history alongside real-time confirmation status across every supplier integrated communication history including email, phone and chat, automated responses based on inquiry type and escalation workflow for complex travel matters. Generic CRM systems have to navigate from one screen or system to another to collect the same type of information, slowing response times, and impacting customer satisfaction.

Travel bookings require confirmation from hotels, transfers, activities, and other suppliers. This is one operational path on which vertical SaaS has clear advantages. These include automated confirmation requests upon booking, multi-channel follow-up (across email, phone, SMS and WhatsApp), multilingual communication with international suppliers, time-zone-specific messaging protocols, real-time status dashboards and automatic escalation for unconfirmed bookings. Such automation negates the need for manual labor and leads to better rates of success.

Travel agencies deal with some very complex financial transactions involving commission reconciliation from a variable number of suppliers, multi-currency payouts and reconciliations as well as profitability analysis by booking source. Features for vertical specific financial platforms include automated calculation of commissions at both supplier and booking levels, multi-currency transaction handling, real-time profitability analysis by product, destination or supplier, automatic creation and reconciliation of invoices and tax compliance to travel-specific regulations. Generic accounting software needs more laborious manual processing to accomplish the same features.

Travel agencies who use vertical SaaS see a 25%-40% cut in operational costs by saving money on customization, integration maintenance, staff training and data processing. These savings are possible though unified platforms that replace several software licenses, automated workflows that reduce repetitive manual tasks, and native integrations meaning you don’t need to build expensive middleware. The savings in efficiency lead to direct improvements in the bottom line, a lifeline for travel MSMEs who operate on very low margins.

According to First Page Sage,B2B travel companies on vertical SaaS are able to keep customer acquisition costs (CAC) between ₹15,000 -30,000 as opposed to a typical horizonal Saas which costs between ₹40,000–55,000. This significant cost differential is the result of faster sales cycles, better solution fit, and less customization at implementation.

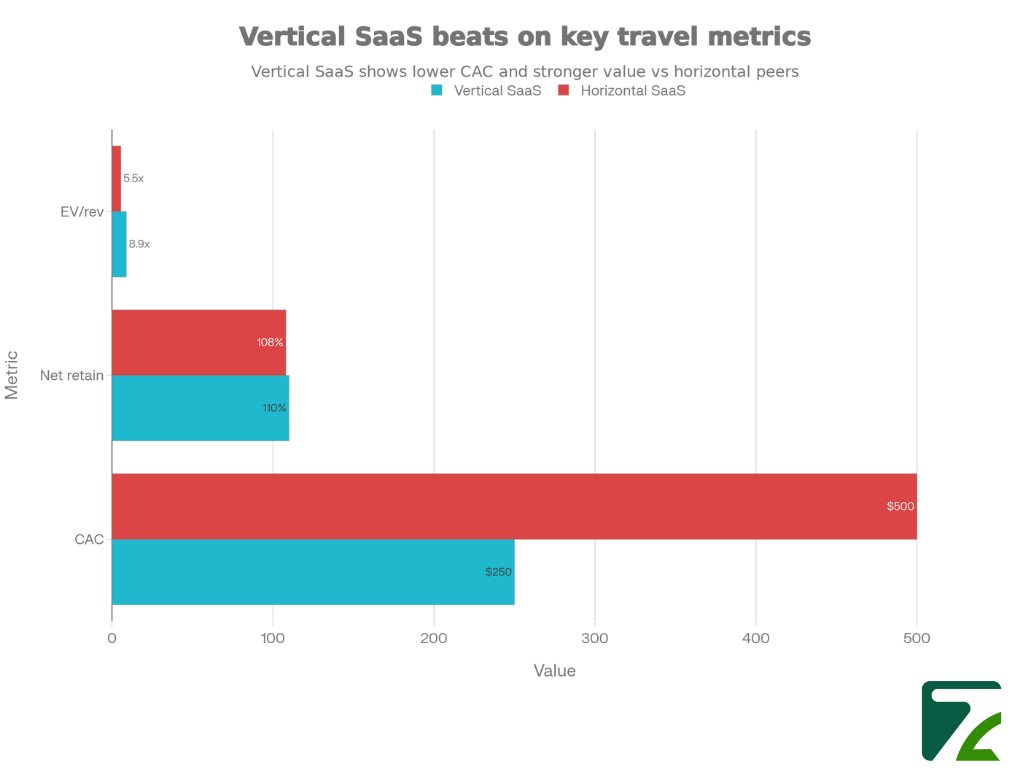

Figure 2: Vertical SaaS performance advantages Vertical SaaS achieves a 50% lower CAC ($250 vs $500), higher net retention (110% vs 108%) and a 61.8% valuation premium (8.9x vs 5.5x EV/Revenue) suggesting that investors prefer niche solutions.

Based on work by Finro Financial Consulting, vertical SaaS companies trade at 12.3x vs. 7.6x in the horizontal space a 61.8% premium that reflects investor confidence in the presence of clear defensible competitive advantages through industry expertise built up over time ,proprietary travel data, and high customer switching costs once workflows are woven tightly into operations.

Critical integrations:

Essential features:

AI in hospitality market was valued at USD 16.33 billion in 2023 and is anticipated to reach USD 70.32 billion by 2031, at a CAGR of 20.36%, according to Kings Research. AI in travel can be used for predictive booking confirmation, automatic communication (available in multiple languages), dynamic pricing based on user’s traveling patterns.

The Market.us wrote that the travel apps software was worth USD 650.7 billion in 2024 and is expected to reach USD 3,552.7 billion by 2034 at a CAGR of 18.50 per cent. This is fueling demand for vertical SaaS products with native mobile experiences tailored to travel workflows.

Traditionally, travel businesses cobbled together a technology stack of five to eight various tools. This leads to data silos, staff context switching, manual reconciliation, and increased total cost of ownership.

Today’s vertical SaaS solutions offer unified systems for booking management, customer relationships, finance, supplier communication and mobile operations within one single integrated platform.

According to Industry Arc,the travel software market is increasingly being adopted by organizations, hence the adoption will rise in future with the help of unified platforms.

Vertical platforms leverage network effects: consolidated bookings improve prediction, visibility into supplier reliability creates value for all users, price intelligence transcends markets and technology partnerships lower costs at the agency level.

Although the vertical SaaS maturity level accelerates, not all travel sub-verticals have equally developed niche solutions available. Consider product maturity in your travel segment, vendor financial stability and customizability for special-needs situations.

Moving from the old system means moving the data, retraining personnel, and having a period of time where two systems are running. However, studies prove that these initial challenges produce a positive ROI in six to twelve months of operational efficiencies.

The travel industry’s movement to vertical SaaS is grounded in the realization that purpose-built solutions outperform generic solutions. As travel technology markets expand & are expected to top USD 18.6 billion by 2033, the gap between vertical and horizontal platform performance will grow even more.

For the OTAs, travel agencies and tour operators that are considering technology strategies, the issue isn’t whether vertical SaaS delivers advantages of market data, and business outcomes clearly show superior performance across a range of criteria. The question from a strategic perspective will then become what types of vertical platforms are most applicable given particular operational needs, growth goals and budget restrictions/tolerances without locking in where implementation is scalable.

The best travel companies that make the choice to run on vertical SaaS set themselves up for operational efficiencies, workforce productivity and competitive edges and become more efficient than any generic platform could ever be. As enterprise-wide AI and cloud applications continue to optimize, these advantages become exponential; making vertical SaaS not only beneficial but necessary to maintain competitive advantage in an ever more digital travel landscape.

The future of technology in the travel industry is a one of dedicated, focused solutions made by teams with deep insight into travel operations, issues and opportunities. While general purpose software continues to play a pivotal role for broad purposes across industries, if you’re running a travel company with intricate moving parts such as bookings engines, supplier relations, and end-to-end consumer experiences, vertical SaaS is the way forward.

Vertical SaaS in the travel industry refers to software built specifically for travel businesses like OTAs, travel agencies, and tour operators, with native support for bookings, confirmations, commissions, suppliers, and itineraries without heavy customization.

Vertical SaaS outperforms generic tools because it matches travel workflows out of the box, reducing customization costs, speeding up implementation, and improving operational efficiency for bookings, confirmations, and financial tracking.

Vertical SaaS automates confirmations, commission calculations, multi-channel bookings, and reporting cutting manual work, reducing errors, and improving staff productivity by up to 40–60%.

Yes. Vertical SaaS lowers total cost of ownership by eliminating multiple tools, reducing integrations, and minimizing training time often delivering ROI within 6–12 months for small and mid-size agencies.

Key features include booking lifecycle management, supplier and commission tracking, multi-channel distribution, automated confirmations, travel-specific reporting, and integrations with GDS and OTA platforms.

Travel Automation Expert