As 2025 nears its end, a look back at the travel industry trends of the year indicates that new OTAs and travel-tech platforms have changed the game. It has been the biggest evolutionary year for online travel agencies in more than half a decade, meaning that AI-driven booking, regional dominance strategies and new innovative payment models have profoundly transformed the way travelers find and purchase trips.

What we witnessed this year was the OTA environment moving from a small number of global powers to an increasingly diverse array of bank-backed portals, AI-born startups, regional leaders, and experience-native niche platforms. As we approach 2026, a grasp on the lessons of the past year is crucial for hotels, travel agencies and tech vendors looking to develop their distribution strategies.

When we look back with the knowledge of 2025 behind us, there is no doubt that promises were kept by the OTA market in terms of its growth both in leisure and business travel segments strengthened by several reports proving a sturdy expansion.

The GM Insights report noted that the worldwide market for online travel agencies reached $269.8 billion in 2025 up from $253.2 billion in 2024, maintaining its course towards $533.7 billion by 2034 with a CAGR of 7.9%. Growth was fueled by increased Internet penetration, smartphone adoption, and the overwhelming preference for self-service booking among travelers.

Grand View Research categorized the broader market at $612.95 billion in 2024, noting that Europe still leads with a 31.87% market share. According to their data, app-based bookings further strengthened their dominance with 52.19% of all transactions this year, proving that mobile-first is now mainstream.

According to Mordor Intelligence, the market hit $553 billion in 2025, while APAC became one of its fastest growing regions with a trend that characterized much of the competitive landscape in 2025.

The verdict: 7-9% annual growth was the norm in 2025 for all sectors, with mobile representation, AI adoption and regional lead industry specialization evolving as significant expansions.

Several structural trends came together in 2025 to drive up new entrant in OTA market:

Mobile-First Became Mobile-Only: Market. us data showed that in 2024 app-based devices held a share of 52.4% and continued to grow through 2025. Many of the new OTAs being established as mobile-only providers bypassed the web completely, targeting this the growing mobile-native traveler base.

AI Integration Went Mainstream: In 2025, The OTAs integrated AI focused on using the technology to drive conversational booking. The OTA market reached almost $107B in 2025 with the core AI powered features around discovery and conversational booking providing an over 7% boost to the sector.

Asia-Pacific boom: 2025 was also the year where Asia Pacific region saw major growth with seasonality and established booking patterns in primary centers now driving significant tourism in secondary markets. 2025 the secondary markets saw a 15% increase in search volumes and a 34% share on total searches in the region during the H1 2025 fueling major booking activity surge in Q3 and Q4 2025.

BNPL Exploded in Travel: The BNPL market globally surged to $560.1 billion in 2025 with travel bookings emerging as one of the fastest-growing use cases, according to Chargeflow’s research. This validated the arrival of fintech-first OTAs with installment-focused travel buying.

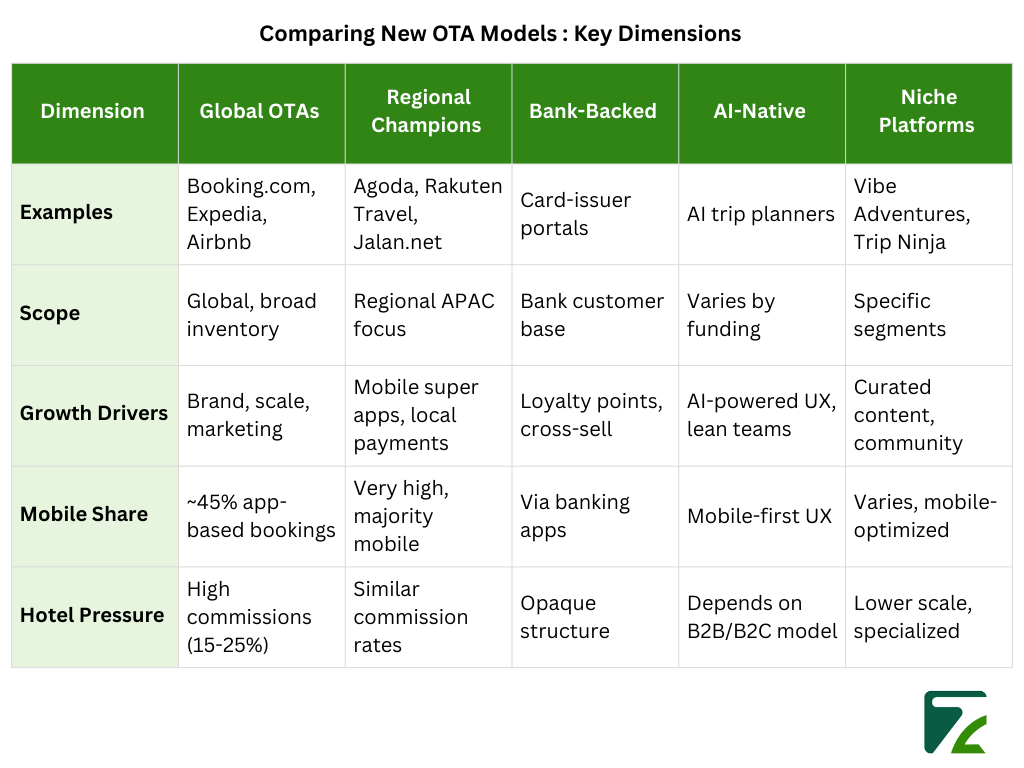

In the course of 2025, five different OTA types either emerged or established themselves, each one reflecting key travel industry trends and targeting specific vulnerabilities in traditional OTA models:

Banks and card issuers are using their customers and transaction data to enter the travel booking space, in some cases becoming “hidden OTAs” stacked on top of existing inventory providers.

A 2025 trends whitepaper mentions that large banks have created or refreshed travel portals that operate similarly to OTAs, leveraging loyalty point currencies, statement credits and targeted offers to capture travel spend in-bank.

These companies frequently integrate into established OTAs or wholesalers behind the scenes, but for the traveler they look like full service OTAs with flight-hotel-car packages. This model drives down acquisition costs through owned channels and makes it difficult for traditional OTAs to recapture customers who are content with “good enough” native booking flows located directly within banking apps.

If there was a flashpoint of the 2025 OTA transformation, it was October’s ChatGPT integration announcement. As per OpenAI’s official release, Booking. com and Expedia were the first major OTAs to integrate with ChatGPT’s new Apps SDK, revolutionizing travel discovery and purchase.

In its post about the launch, Skift pointed out that Booking. com and Expedia have released interactive experiences in ChatGPT, where you can look up hotels, flights and receive personalized recommendations using natural language. Clayton Nelson, VP of Strategic Partnerships at Expedia Group shared that this initial traffic from generative AI search was small but grew rapidly throughout Q4 2025 and ultimately converted to bookings at a higher rate than other traffic sources.

Based on analysis by PhocusWire, ChatGPT’s 800-million-strong user base was provided with the real-time flight and hotel data access through these integrations in the final three months of 2025. In December, users were able to receive live pricing data, compare options, and see interactive maps all without leaving the conversational interface.

The effect was immediate: AI systems favored properties with full, high-quality information and good reviews kick-starting a new form of competition in which data quality was as important as price. AI requirements in both content generation and search for new-entered OTAs at the end of 2025 went from “nice to have” to table stakes for any platform entering in 2026.

2025 was the pivotal year for Asia-Pacific OTAs. Asia accounted for 9% of global international arrivals in 2022, rising to 28% by mid-2025, driven by increasing middle class incomes and better accessibility as well as government promotion of tourism, the Agoda’s localization report said.

Agoda’s year-end data unveiled the most surprising find of 2017: hotels adopting sophisticated localization strategies were 59% higher in RevPAR and up to 95% more repeat booking than their counterparts using a single approach for all markets. The report found that only 80% of high-performing hotels utilized OTA partners such as Agoda for guest insights and digital tools to facilitate multilingual and multi-currency engagement.

Mordor Intelligence’s ASEAN analysis noted the growth of the online accommodation market in the region came to over 5% by 2025, with regional preferences clearly defined:

These local platforms thrived by incorporating tens of localized payment methods (Alipay, WeChat Pay, regional e-wallets) and distributing content in local languages with cultural nuances that global OTAs found impossible to replicate against in 2025.

Instead of trying to go as low as possible on price for commodity flights and city hotels, many new OTAs 2025 make business models carving out niches around certain experiences or segments or destination types.

Vibe Adventures centers around multi-day organized trips that include flights and accommodations packages with curated experiences sourced through APIs.

Trip Ninja uses machine learning that maximizes complex flight itineraries addressing the needs of both agencies and travelers.

Another recent entrant is also focused on niche and emerging destinations, linking travelers to this under-served region through a platform accessed by hundreds of airlines, hundreds of thousands of hotels and experiences in markets across Africa (and island states).

These models prevail by offering depth rather than breadth curated product, local ground suppliers, and community-driven discovery) of interest to travelers who are fed up with big multipurpose OTAs being all things to all people.

BNPL went mainstream as a payment option in travel by 2025. The global market for BNPL hit $560.1 billion in 2025, up 13.7% year-on-year, and travel bookings became one of the fastest-growing sector groupings worldwide, according to Chargeflow’s year-end wrap-up.

The numbers tell the story of BNPL’s 2025 surge:

Market Leaders: ResearchAndMarkets. com noted Klarna, Affirm and Afterpay led the way in travel BNPL in 2025. Affirm posted 47% revenue growth in February 2025, rising to $770 million while increasing its user base to 21 million. Klarna went public in early 2025, with a valuation highlighting BNPL’s maturation.

User Adoption: The Motley Fool’s 2025 BNPL research report stated that 15% of American adults employed BNPL in 2024, with use increasing over the course of 2025. Usage skewed young, with nearly 1 in 5 Americans under the age of 45 having used BNPL for travel or other items, Federal Reserve data shows.

Merchant Impact: US BNPL slipped to $170.32 billion in 2025, according to Mordor Intelligence figures. For the OTAs, the retail adoption of BNPL prompted increases in both conversation (20%-30%) and average value order (30%-50%), metrics that were catalysts for broad industry OTA adoption in late 2025.

By the end of the year, BNPL integration had gone from a competitive advantage to a table stake. When new OTAs opened their doors in the late 2025, BNPL featured as one of the default checkout options for these sites specifically targeting long-haul international travel, study-abroad programs and premium tickets where payments in staged availed premium class travel accessible to budget-conscious millennials and Gen Z.

Three major shifts shaped how new OTAs positioned themselves throughout 2025:

According to the October 2025 announcement by OpenAI, Booking.com and Expedia now allow users to engage with GPT-based engines for trip discovery and booking, transforming the search box into a virtual travel assistant. According to ShortTermRentalz, users are able to check live flight and accommodation information, compare prices, and explore interactive maps without having to exit ChatGPT.

eMarketer research reveals that nearly 3 in 10 US consumers (29%) are already using AI services to plan their trips, while generative AI traffic to US travel sites has surged dramatically since July 2024. The study finds that more than half (53%) of people who have used AI to plan their trips turned to the technology to discover local hotspots, restaurants, and travel tips.

These artificial intelligence layers favor properties with strong visuals, detailed descriptions, and well-recorded review histories. For new OTAs 2025 who are just starting, it’s not even an option; they must embed AI in the very first day to afford a modern user experience.

Social platforms and OTAs are converging now: social apps integrate with OTA’s booking flow, and OTA leverage the short-form video (social content) as input for itinerary generation. Roughly 80 percent of younger travelers depend on social content to determine where they should go and stay.

New OTAs 2025 can take advantage of them by creating social-first discovery flows, shoppable videos, creator-led itineraries instead of search-driven funnels that favour the incumbents with large marketing budgets

Sustainability filters, eco-certification badges and carbon-footprint indicators are becoming more prevalent in OTA interfaces as a result of increasing traveler demand for low-impact stays and transportation. This creates space for new platforms like those that cater to eco-conscious travel, which can gain loyalty even at price parity by resonating with traveler values.

The new OTA landscape is a mix: a risk and leverage. Greater reliance on a wider range of OTAs, regional platforms, bank portals and niche specialists means increased rate and content management complexity but more options to diversify away from any single dominant intermediary.

Hoteliers who reliably update OTA content, maintain active review management and compete on experience rather than price tend to perform well in both traditional OTA search and AI-driven discovery.

Commission levels in the 15–25% range is still an issue, but this will again pressure hotels to find a proper balance between OTA share and direct booking strategies, metasearch and loyalty programs.

AI-native solutions that help you to optimize complex itineraries, automate quoting and integrate with multiple content sources via API are increasingly a must-have in order to keep up. New entrants offering these tools can capture significant value within the ecosystem.

It pays back in terms of potential integrations but also means that you need to support many more regional and niche OTAs, banking partners, and AI-powered front ends. Connectivity platforms, reconfirmation tools, and rate intelligence providers need to respond to this complexity.

As we come to the end of 2025, the online travel agency world looks completely different. The OTA market expanded from $94 billion in 2024 to just under $107 billion as we headed into late 2025 a robust, if opaque 7% growth figure that belied dramatic changes occurring beneath the surface.

The October introduction of ChatGPT was the moment when AI moved out of the experiment room and started becoming infrastructure. OpenAI’s app store debut included Booking. com and Expedia into conversational commerce, which eMarketer said converted to AI-driven bookings at a higher rate than normal search traffic.

Asia-Pacific emerged as the growth engine. According to Agoda, hotels that implemented localization saw RevPAR gains of 59%, and the region’s share of global arrivals rose from 9% to 28% in only three years.

BNPL went mainstream. BNPL went mainstream. With the market at $560 billion worldwide and OTAs reporting 20-30% conversion lifts, installment payments shifted from experimental to standard practice.

Regarding hotels, Grand View Research’s findings backed up this trend with 52.19% of bookings now taking place through mobile apps, proving that you need to have mobile-optimized content in order to be considered. With OTA commissions still in the 15-25% range, direct booking strategies remained critical for margin protection.

The fragmentation that emerged out of 2025 posed both integration challenges and opportunities for travel tech providers. There was a substantial need to cater to regional OTAs, banking partners, and AI-driven platforms.

For the OTAs themselves, the market capitalization data as of July 2025 from Statista showed Booking Holdings still on top but a smaller margin thanks to specialized players taking some segments captive.

Based on 2025’s momentum and early 2026 indicators, five travel industry trends will likely dominate the coming year:

The 2025 travel industry trends teach us a simple lesson: Winner takes it all is no longer true in the OTA ecosystem. Succeeding in 2026 Look at the new categories offered by OTAs and understand which one’s line up with your target segments and distribution strategy.

Don’t chase every platform. Instead, consider where your ideal clients are booking:

And as we step into 2026, the winning strategy isn’t maximum distribution, it’s strategic distribution that takes into account a balance of visibility, cost per commission, and customer acquisition quality.

New OTAs in 2025 include AI-native booking platforms, bank-backed travel portals, regional Asia-Pacific OTAs, BNPL-focused travel apps, and niche experience-based platforms.

New OTAs focus on AI booking, mobile-first design, local payments, and niche travelers, while traditional OTAs rely on scale, broad inventory, and heavy marketing.

AI enables conversational search, personalized trip planning, and real-time booking through tools like ChatGPT, reducing the need for traditional search-based booking.

BNPL makes travel more affordable by spreading payments over time and boosts OTA conversions, especially for long-haul and premium trips.

Hotels should track AI-driven booking, regional OTA growth, BNPL adoption, sustainability filters, and stronger direct-booking strategies.

Travel Automation Expert