Revenue leakage is the revenue your travel agency should be collecting but doesn’t because it never gets collected. It’s as if there are holes in your bucket, and so no matter how much water you put in, some always flows out. As a travel agency where margins are slim, usually anywhere from 10-20%, a dollar lost is a direct dollar off to your bottom line.

Four in five executives view revenue leakage as a chronic problem, with 45 percent saying it’s systemic for their companies, according to Boston Consulting Group. In the travel world, the problem is even more complicated because agencies work with several suppliers, complex commission schemas, and countless booking channels.

So, let’s dive into how and why revenue leakage occurs in travel operations and what you can do to prevent it.

Travel revenue leakage is money you’ve earned but not received because of operational issues, technology problems, or human error. Instead of being a victim of tourism leakage, where tourist dollars go to foreign firms, you become a victim of your own company in the case of operational revenue leakage.

If you booked a $5,000 vacation package for a client and are supposed to make a $500 commission but receive a $400 commission as a result of tracking glitches, you just lost $100 to revenue leakage. Multiply that over hundreds of bookings, and the losses can add up fast.

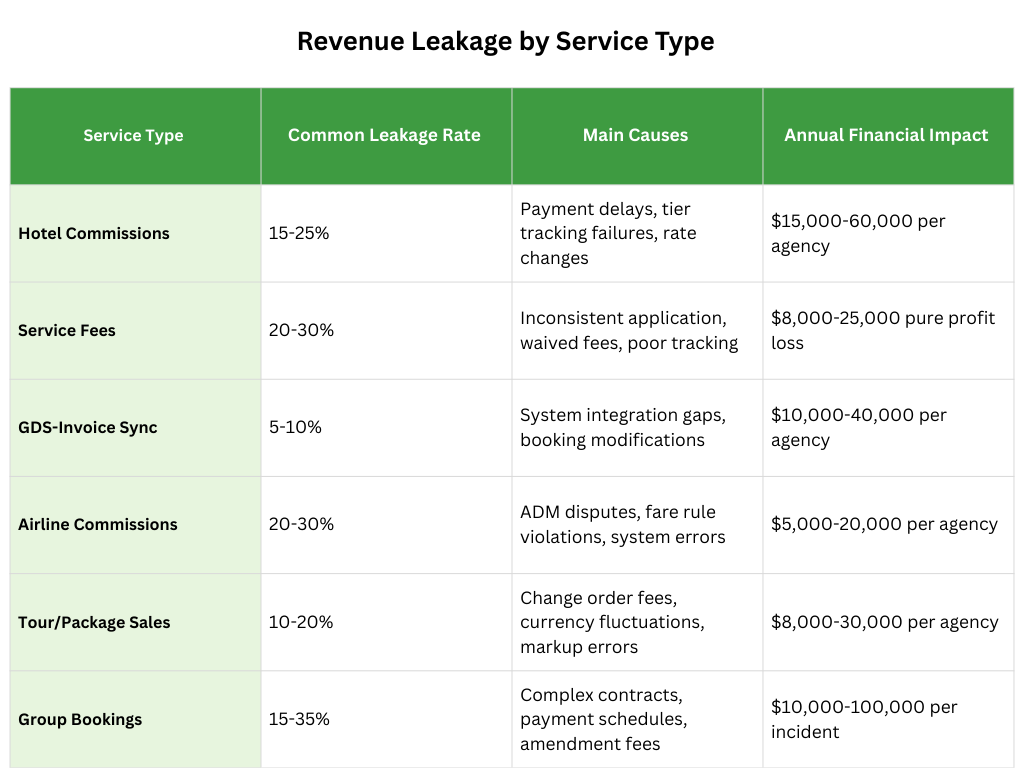

Commission tracking is one of the largest revenue sources of leakage for most agencies and is 70-80% agency revenue in most cases. According to Onyx Center Source research, supplier commission tracking discrepancies have agencies losing between $5,000-$50,000 a month in revenue.

The most common problem for agencies is non-payment of commissions. Industry records indicate more than 40% of commissions have errors or are never paid. This occurs through several mechanisms:

Modern commission systems are so difficult that systematic revenue leakage occurs for the majority of agencies, and they don’t even know it. Today the majority of large hotel chains have implemented 3-4 tier commission models based on annual volume of sales. A typical structure might include:

Tier 1: $0-$250K sales annually = 8%

Tier 2: $250K-$500K annual sales = 10% commission.

Tier 3: $500,001 – $1M In annual sales = 12% commission

Tier 4: $1M+ per year in sales = 14% commission + 2% override

Agencies frequently miss out on thousands in payments because they fail to track precisely when they surpass thresholds. If you actually attain Tier 3 in July but do not inform the vendor, you will continue to be paid Tier 2 prices through the end of the calendar year.

Suppliers often change their commission rates seasonally or by product category, which agencies often overlook. Summer cruise commissions rise to 12-15% from the regular 10%, and European hotel chains pay 2-3% bonus commissions during shoulder seasons. In many cases the same supplier is paying different commissions for different products which results in tracking nightmares such as hotel room-only bookings paying 10% standard commission whereas hotel plus package deals are paying 12%.

For example, imagine that you are a mid-size agency with annual sales of $2M. In traditional commission tracking, they could make $200K annually in commission income. But with optimal structure commission tracking they could have harvested revenues of $260K per year. That’s $60,000 of pure profit that the agency lost money it made but never saw thanks to poor commission structure management.

Fox World Travel states that 37% of hotel bookings and 15% of flights are booked outside corporate channels on average, likely leading to booking leakage. For travel companies, it has translated into lost commissionable revenue when customers bypass agencies and book directly with suppliers.

According to a recent Christopherson survey of 100 travel managers, fewer than half guessed that they had travel leakage at 10 percent or less. The main impacts include:

Service fees are pure profit for travel agencies no cost of goods, no supplier dependency, strictly revenue. But recruitment firms lose 20-30% of potential service fee revenue to under-collection behavior.

Study finds that 67% of agencies fail to include service fees on complex itineraries, 45% don’t charge fees on booking changes or modifications. Only a meagre 23% of serviced apartments currently have automated service fee application systems with substantial profit leakage.

The largest gaps come in consultation fees never submitted. Lots of agencies do it for hours and never end up billing for it:

Transaction charges are equally arbitrary. Thus, a fee of $25-50 for booking an airline ticket may be waived and a fee of $15-25 for making a hotel reservation may be ignored. The processing of change and cancellations is another huge gap, where costs are taken by the agencies versus charging clients.

For a typical agency with 500 bookings a year, the standard service fee total should be $37,500. The reality is, however, under-performing collection systems collect only $26,250, resulting in annual revenue leakage of $11,250. That’s pure profit loss, since service fees fall directly to the agency’s bottom line.

5 – 10% revenue leakages arise due to booking to invoice gaps at all travel agencies on global distribution systems. These differences occur on a day-to-day basis, but are often not noted until they congregate as massive losses.

There are numerous problems that arise when GDS bookings do not flow correctly to invoicing systems. For complex multi-city itineraries, segments vanish during the transfer, while ancillary services, such as seat selections and baggage fees, often do not make it. Group bookings often incorrectly broken down to single invoices and international bookings can miss currency conversion information.

Many agencies producing 50-100 bookings per day suffer 5-15 GDS-invoicing related discrepancies for manual reconciliation. This takes 2-4 hours of staff time per day and equates to $500-2,000 lost per week in missed items, accumulating to a range of $26,000-104,000 in lost revenue per year from system-wide voids.

When booking rules are broken, ADM’s come into play by the airlines and can be a major source of revenue leakage for travel agencies. From a 2017 IATA analysis on ADM management, it was identified as an important component of revenue assurance.

Most ADMs are raised for booking class violations (e.g. booking advance fares with wrong dates). Fare rule breakage, cancellation not properly processed, and penalty miscalculation also contribute to make costly ADMs. Most agencies are losing money by paying out nonvalid ADMs or not disputing valid ones in a timely manner.

Our industry-wide analysis indicate that the problem of revenue leakage is exacerbated due to inconsistencies in ticket fares sold by sales agents, along with cut-throat competition, refund and cancellation of tickets, exchange rate fluctuations, incorrect calculation of penalty, etc.

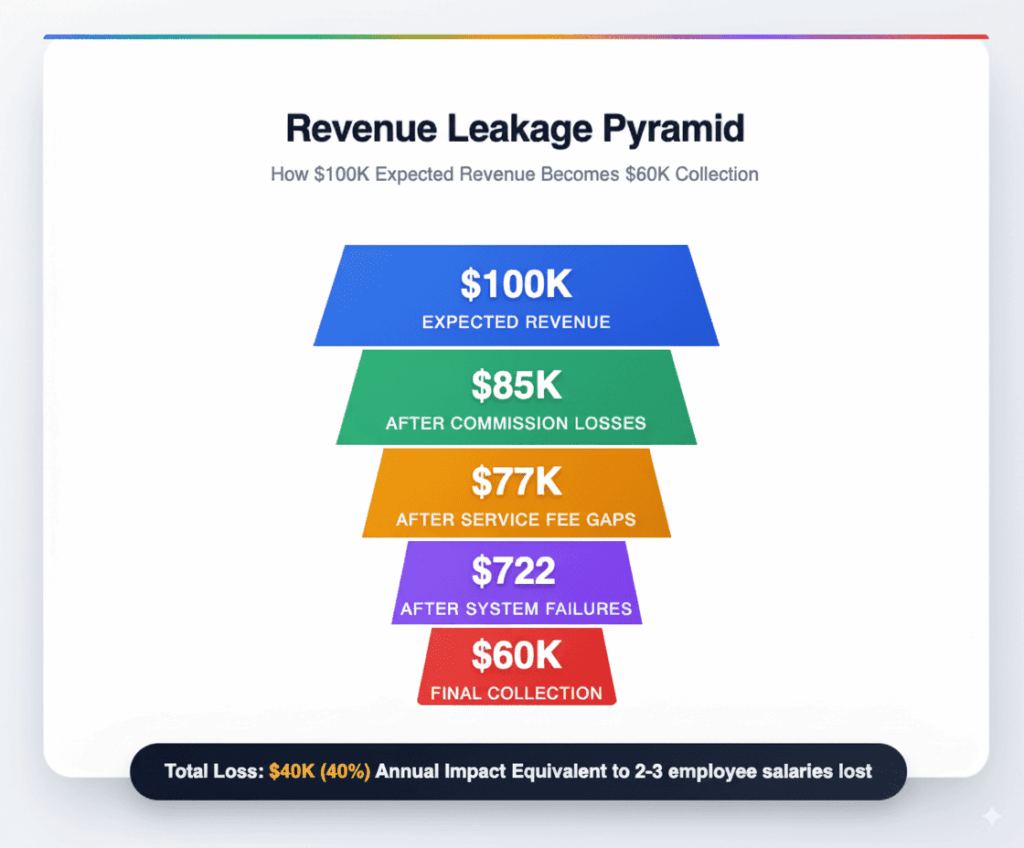

The costs of revenue leakage may differ in volume from one agency to the next, but its impact is felt and experienced in all cases. Small-sized agencies with under $500K in revenue usually run on profit margins between 10-15%. Only 2% revenue leakage means $10,000 lost on $500K revenue about three months of the salary of a new agent.

Mid-size, $1–5M revenue, agencies typically see 15–20% profits. That means, for these firms, revenue leakage of 3%, which amounts to $90K lost on $3M in revenue (for many solo/similar-sized agencies that’s the equivalent to their profit for the year). Big agencies, which are those with more than $10M in revenue, can experience profit margins of 20-25%, yet just 2% revenue leakage amounts to more than $200,000 every year that is same to four and five full-time employees.

And with BCG research that proves that companies that focus on revenue leakage prevention can add upwards of 5% back to their bottom line, this is one of the highest leverage improvements agencies can make.

According to data from Onyx CenterSource a typical client sees a minimum increase in commissions collected of 20% utilizing professional recovery services. This is how much money agencies usually lose due to inaccurate commission tracking.

One success story reads: With the first 15 months of using Net Trans (an Onyx CenterSource company) to reconcile our travel agency

Data compiled from industry sources and agency surveys

Tracking, the basis of blocking revenue from leaking. Utilize commission tracking tools and keep detailed track of all bookings and anticipated commission. Ensure to reconcile supplier statements on a monthly basis instead of quarterly to identify discrepancies early.

Here are some things you can focus on controlling in your agency operations in order to stop losing revenue. Have transparent policies regarding service charges, and that all staff know when and how to apply them. Create processes for systematically tracking commissions and chasing overdue pay.

Key internal controls include:

Use technology to avoid manual errors and system holes. Activate automatic service fee invoicing. Initiate alerts for unpaid commissions. Focus on these key areas:

Implement regular review methods to identify and fix leak points. Conduct monthly commission statement checks, quarterly full audits, and annual procedure reviews. Teach your team members to identify typical leak patterns and ensure that there is a clear protocol in place to respond to changes and challenges.

Specialized commission tracking and recovery services are offered by companies like Onyx CenterSource and Sion Central. These systems offer automation for reconciliation of data disputes and a range of reporting options.

Today’s travel technology providers are developing systems that integrate booking, accounting and commission tracking all in one place, minimizing the areas where potential revenue is lost. Such solutions normally provide real-time data synchronization, automatic fare calculation, and extensive audit trails.

When it comes to revenue leakage, choosing the correct agency technology partner is key to the success of your agency. Also keep your eyes open for products which provide full commission tracking against a variety of suppliers; real-time reports for unpaid bookings; notifications for anomalous bookings; and simplified reconciliation solutions.

The top technology solutions will not disrupt your current processes and will give you the visibility and control required to stop budget loss.

Revenue leakage isn’t a small operational problem it’s a giant liability for your agency’s profitability. As travel agencies are operating on thin margins, losing 2-3% of the revenue to the leakage can wipe out 20-30% of your annual profit.

The silver lining is that much of revenue leakage can be prevented. With the right tracking systems in place, staff training and technology, you can plug these profit leaks and keep more of the money you take in.

Just remember: Revenue leakage happens to every agency, but smart agencies take systematic action to prevent it. It is not a matter of whether your agency is suffering from revenue leakage; it is a matter of whether you are willing to do anything about it before it leads to failure in your business.

Begin by auditing the way you currently do things and figure out where money is being wasted, then implement fixes one at a time.

Travel agencies lose anywhere between 2–5% of total revenue annually to leakage, which can equal tens of thousands to millions of dollars depending on agency size. For a mid-sized agency with $3M in revenue, this could mean $90,000 lost, often wiping out the entire annual profit margin.

The biggest culprit is commission tracking and collection failures, which impact 70–80% of agency income. Missing or delayed hotel commissions, untracked tier upgrades, and unnoticed discrepancies often account for 15–25% of lost commission revenue.

Agencies should use specialized commission management platforms (e.g., Onyx CenterSource, Sion) to reconcile payments, dispute discrepancies, and track tier thresholds. Monthly reconciliation instead of quarterly reviews helps catch errors early, while automated alerts ensure no commission goes uncollected.

ADMs are penalties issued by airlines when agencies violate booking rules, fare conditions, or ticketing policies. They drain revenue through invalid penalties, fare miscalculations, and rule violations. Many agencies lose money by either paying disputed ADMs unnecessarily or failing to contest them promptly.

Key solutions include commission management systems, integrated booking-accounting platforms, GDS-invoicing sync tools, and automated service fee applications. Together, these tools provide real-time reconciliation, error alerts, and process automation, enabling agencies to plug leaks and protect profit margins.

Travel Automation Expert