In today’s rapidly evolving tax landscape, businesses face increasing complexity in managing tax obligations. Outsourced tax preparation is emerging as a critical solution, helping businesses ensure compliance, reduce costs, and focus on core activities. In this comprehensive guide, we explore the benefits, address common misconceptions, and provide actionable insights to effectively outsource your tax preparation in 2025.

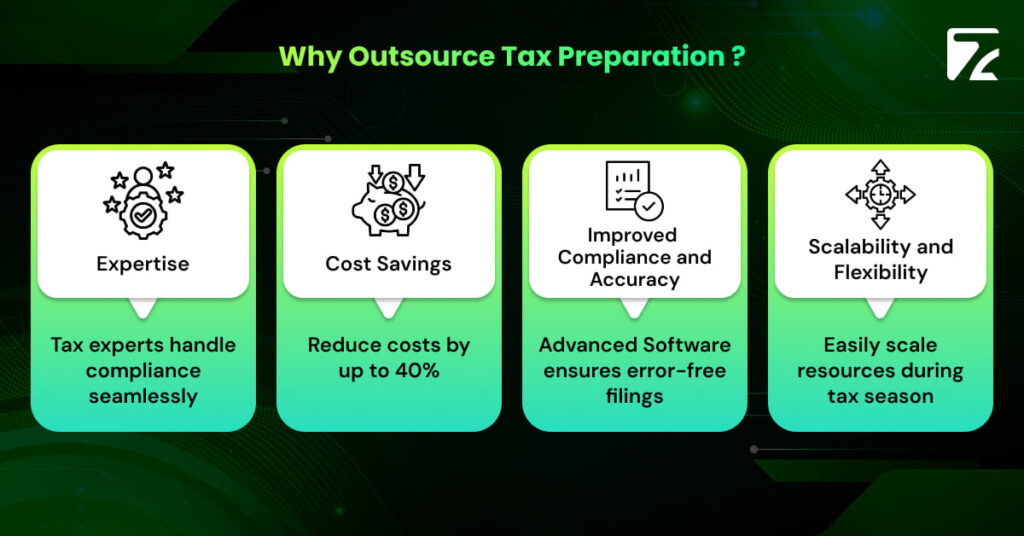

Outsourcing gives your business immediate access to tax specialists who stay updated on complex and changing regulations. Imagine a scenario: your business misses an update in GST regulations this small oversight can result in costly penalties. By outsourcing, experts handle these changes seamlessly, safeguarding your company against compliance risks.

Hiring an in-house tax preparation team involves substantial costs, including salaries, training, and technology. A recent industry survey revealed businesses can save up to 40% annually by outsourcing their tax preparation compared to maintaining in-house staff.

Outsourced tax preparation services utilize advanced software and rigorous quality checks, drastically reducing errors. A notable example includes businesses that successfully avoided audit triggers through accurate VAT filings managed by outsourcing partners.

Tax workloads fluctuate throughout the year, peaking during filing seasons. Outsourcing allows you to scale resources flexibly without the headaches of seasonal hiring.

By offloading tax preparation duties, your internal team can dedicate their efforts toward strategic business initiatives. For example, a small e-commerce firm significantly boosted its product innovation and customer service after outsourcing tax-related tasks.

Tax preparation outsourcing integrates smoothly into your business processes, offering seamless transitions without operational disruptions. Advanced technology ensures real-time updates and effective workflow management, enabling smoother tax handling.

Outsourcing firms specialize in precise compliance, significantly lowering your audit risk. In fact, businesses that outsource their tax preparation have reported a 60% reduction in audit incidents due to improved accuracy and adherence to regulatory norms.

Offshore outsourcing, particularly in countries like India and the Philippines, is known for being highly cost-effective due to lower labor costs. However, it’s essential to carefully assess the provider’s expertise in your specific tax requirements and verify their compliance with international standards and local regulations.

Domestic outsourcing offers advantages such as cultural compatibility, easy communication, and faster responsiveness due to similar time zones. While slightly costlier than offshore alternatives, it offers peace of mind regarding data security and legal compliance.

Many businesses today prefer a hybrid approach, leveraging offshore providers for routine tax preparation tasks while keeping more complex, strategic tax planning and compliance tasks domestically outsourced.

To gauge the effectiveness of outsourced tax preparation, consider tracking these critical performance metrics:

With growing emphasis on Environmental, Social, and Governance (ESG) factors, outsourced tax preparation providers can help your business align tax strategies with ESG compliance requirements. For instance, providers can assist in leveraging tax incentives for sustainability initiatives, renewable energy projects, and community-oriented investments.

Many businesses hesitate to outsource fearing loss of control over sensitive financial information. However, reputable outsourcing partners provide transparent communication tools, dashboards, and regular reporting, ensuring you maintain complete oversight.

Data protection is paramount in tax preparation. Reliable outsourcing providers implement strict security protocols, encryption methods, and compliance with global data protection standards like GDPR, reducing your data risks significantly.

| Industry | Benefit of Outsourcing |

|---|---|

| Tech Firms | Keeping pace with technology-specific tax codes |

| Retail & E-commerce | Handling high-volume transactions efficiently |

| Healthcare | Ensuring regulatory compliance |

| Manufacturing | Optimizing cost and efficiency |

Consider firms with proven industry experience and check their client testimonials. Providers with experience handling businesses similar to yours offer better compliance and efficiency.

Opt for outsourcing firms employing cutting-edge software and automation tools like AI-powered compliance systems, enhancing accuracy and responsiveness to regulatory updates.

Choose providers strictly adhering to data security protocols, including secure servers, multi-factor authentication, and regular security audits. to know more The Hidden Risks of In-House Tax Preparation and Why Outsourcing is the Smart Move.

Clearly outline tasks, deadlines, and performance expectations. For instance, define monthly reporting timelines and specific compliance benchmarks clearly upfront.

Regular check-ins and performance reviews help address any issues promptly and ensure alignment between your internal team and outsourcing partner.

Conduct periodic audits to review performance metrics, ensuring your outsourcing partner continuously meets set objectives and standards.

Outsourcing tax preparation in 2025 provides businesses with expert-driven compliance, significant cost savings, and operational efficiency. Selecting the right partner, leveraging modern technology, and maintaining clear communication can dramatically enhance your tax compliance process.

Yes, trusted providers follow strict security measures like encryption and GDPR compliance.

Businesses save up to 40% annually on staffing, software, and penalties.

No, you get real-time dashboards, reports, and full oversight.

E-commerce, healthcare, real estate, IT, and manufacturing see major advantages.

Travel Automation Expert