Selling online is exciting until the numbers start getting weird.

One week, you’re celebrating your best sales day. The next, you’re squinting at spreadsheets, trying to figure out if you actually made a profit. It’s not just you this happens to most founders once things start scaling.

E-commerce finance is complicated. Between multiple platforms, currencies, ad spend, and tax rules, it’s easy to lose control of your numbers.

That’s why more e-commerce brands are outsourcing their finances. Not to pass the buck but to get their time (and sanity) back.

Let’s paint a quick picture. You’re selling on Shopify but also listing a few products on Amazon. You accept payments through Stripe, maybe PayPal too. Then there’s Meta ads, Google ads, influencer payments, refunds, shipping costs, VAT in Europe, GST in Australia… yeah, it’s a lot.

And if you’re managing all that solo (or with a tiny team)? Burnout is inevitable.

Here’s what makes it tough:

That’s where outsourced financial services come in. They’re not just bookkeepers. They’re problem solvers who specialize in e-commerce.

In simple terms, it’s a team (or person) who handles your financial operations, without being on your payroll.

But we’re not talking about old-school accountants in suits. These are professionals who work with online brands daily. They understand your platforms, payment processors, and the weird little fees that make your numbers hard to pin down.

The best part? You get access to that brainpower without paying full-time salaries.

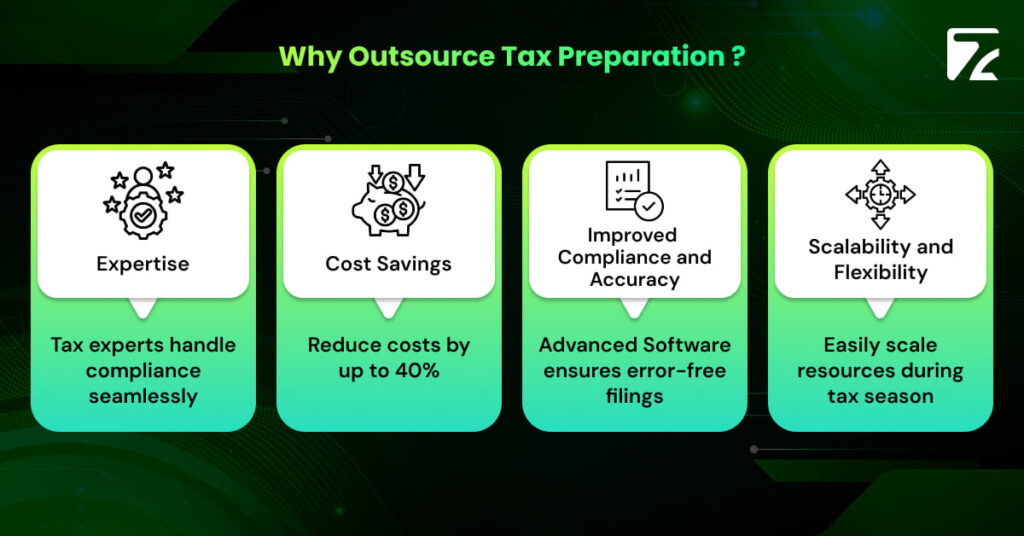

Hiring an in-house finance team is expensive. Outsourcing gives you top-tier talent without the full-time costs no health insurance, no training, no overhead.

You need more than a general accountant. You need someone who knows how to track COGS for Shopify, handle Amazon FBA fees, and prep you for tax season without a meltdown.

One missed tax filing or reconciliation error can cost thousands. Outsourced teams use tools, audits, and checklists to keep your finances error-free and regulation-ready.

Sales go up in Q4? Great! Your outsourced team can flex with you no last-minute hiring or panicked weekends catching up on reports.

With clean dashboards and real-time updates, you’ll actually know what’s happening with your money. Margins, cash flow, ad ROI it’s all visible, and that makes decision-making a whole lot easier.

Your business isn’t the same in April as it is in November. So why treat your finances like they are?

Instead of hiring temp finance staff or working nights, your outsourced team expands their support. More transactions? More reporting? Handled.

Lots of orders doesn’t always mean lots of cash. Your finance partner helps plan reserves, manage payouts, and avoid the January dry spell.

Running out of stock during Black Friday is a nightmare. Good finance teams help forecast inventory and even assist with getting funding or negotiating supplier terms.

After the holiday chaos, did those discounts help or hurt your bottom line? Outsourced CFOs give you full campaign and cost breakdowns so you can plan better next time.

A gourmet food and beverage e-commerce retailer, experiencing rapid growth since its inception in 2014, faced operational challenges due to its expanding scale. The owners, who were managing financial functions themselves, encountered inefficiencies and lacked timely financial insights. By partnering with an outsourced accounting firm, they gained access to professional financial management, leading to improved financial reporting, better expense tracking, and enhanced decision-making capabilities. This collaboration allowed the owners to focus on strategic growth initiatives, contributing to the company’s continued success.

An Australian e-commerce company specializing in supplements sought to optimize its finance operations. By collaborating with Business Avengers, the company outsourced its bookkeeping, payroll, and financial modeling functions. This strategic move resulted in a 46% reduction in finance-related costs, amounting to annual savings of $304,000. The streamlined processes and cost efficiencies enabled the company to allocate resources more effectively, leading to improved financial management and business growth.

These case studies demonstrate that financial outsourcing can lead to significant cost savings, improved financial accuracy, and enhanced focus on strategic business areas, ultimately contributing to increased profitability for e-commerce companies.

Short answer: yes when done right.

Here’s how to protect your business:

Look for:

And don’t forget:

Choose a provider who understands e-commerce. A traditional accountant might be great for a bakery but not so much for a Shopify store with split payments and global shipping.

Managing your finances on your own might work at first but it’s not built to last. When things pick up, you need systems, support, and strategy.

Outsourcing your finances doesn’t mean giving up control. It means gaining clarity, freeing up your time, and growing with confidence.

You can outsource everything from bookkeeping, tax filing, and payroll to inventory costing, cash flow planning, and even CFO-level guidance.

Absolutely. The right team will scale with you offering faster reporting, more insights, and extra support when you need it most.

Yes. Just make sure your provider uses secure platforms, complies with data laws like GDPR, and offers confidentiality agreements.

They help with cash flow strategy, budget planning, performance tracking, and financial decision-making especially useful if you’re planning to raise funds or expand.

Travel Automation Expert