Peak season is a customer service stress test for travel firms. High-revenue, but high-risk times with game breaking faults in service infrastructure that can destroy customer relationships and brand value in a matter of hours.

The travel industry learned that the hard way in 2024. For big OTAS, reservation system outages are very costly. Big OTAs endured an estimated $28 billion in combined losses from reservation system failures in 2019, with Expedia alone losing $12 billion because of the spring break surge. These avatars of incompetence were not anomalies; they were the infallible products of systemic customer service dysfunction that the crush of the peak season brutally exposed.

So, why is it always bad during the peak seasons when it comes to the customer service? The challenge is in the interplay of technology constraints, operational challenges and economic realities for travel firms. This classification has important implications for discovering the locations which the agencies can concentrate on remediating more precisely.

The travel industry’s failures in customer service during peak season are due to the gross miss-match of capacity versus demand. The American Customer Satisfaction Index (ACSI) Travel Study 2025 found that customer satisfaction in the travel sector took a major hit as airlines fell 4% to a score of 74 and online travel agencies fell 3% to 75.

These dissatisfactions occur precisely when travel companies should be at their best. Peak seasons have 15 to 30% more demand than shoulder seasons, but that’s not how customer service resources scale in the real world.

The numbers show a terrible trend in wait times, which is downright ugly when it’s busier than usual:

These already insufficient response times swell during peak times of the year, a factor that can be maddening for those seeking to reach out and get time-sensitive, urgent help with something like rebooking or flight changes or even just that their booking has, in fact, been made.

There are real side effects to an industry-wide cost of $28 billion in 2024: businesses lose an average of $2,400 in customer lifetime value (CLV) for every business customer they lose, and 35% of peak season marketing spend is wasted as 60% of consumers report they will rarely or never buy again from a business that gave them a bad customer experience in the first interaction.

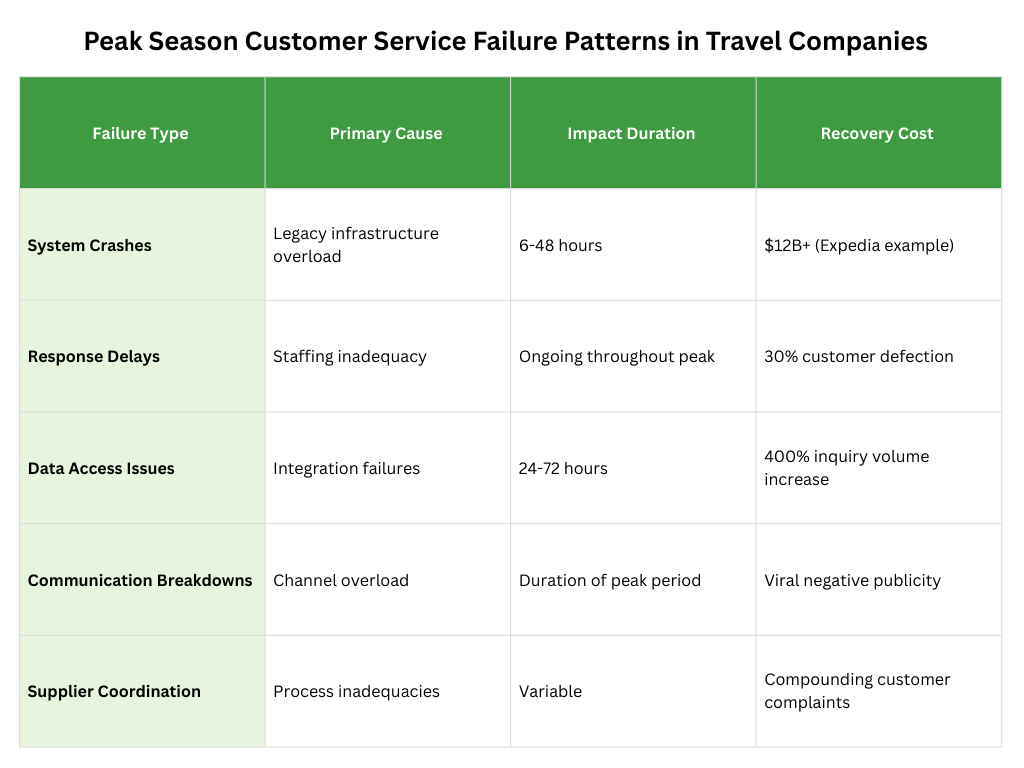

The main customer service headaches for service providers are technical infrastructure problems at peak times. The 2024 reservation system shutdown is a perfect example of how old technology leads to cascading service failures.

Expedia’s peak season meltdown for spring break is a case in point of the way legacy booking platforms crumble under the strain of peak demand. Technical investigations showed that off-peak load testing did not reflect actual traffic peaks and determined significant shortcomings in capacity planning. The failure wasn’t gradual. The system simply fell over, rendering customer service agents unable to retrieve booking information for existing customers in need of assistance.

Priceline’s mid-summer meltdown showed how accrued technical debt leaves you vulnerable at times of high stress. Years of deferred system maintenance and shortcuts in development finally caught up when peak demand tested the infrastructure’s limits.

The disparity in newer vs. older system capacity is revealed under peak load conditions. Cloud travel businesses certainly saw the same spikes in demand as the legacy server-based services but hardly the same level of problems. Legacy systems simply cannot do on-demand scaling like cloud systems.

When the primary systems crash, the knock-on effects mount quickly.

Customer service failures in the peak season often start with a structural mismatch between staffing models and the reality of demand. Every single time, travel companies struggle to maintain customer service during these spike periods.

Industry data indicates an alarming baseline performance exacerbated during busy times. The average live chat wait time of customers across the industries also indicates that the acceptable response time is 35 sec, with optimal performance at 15 sec. But travel firms can’t rise to this level of expectation even in normal times.

The response time challenge compounds during peak seasons when:

For peak season, customer service demands are different than those for routine booking. They have to have crisis communication skills, complex rebooking expertise and strong emotional intelligence for handling stressed travelers well. The customized training doesn’t pay off for most travel companies.

The United Airlines holiday app crashes show how operational glitches make for messy customer service situations. When the app crash led to nearly 3,000 grounded flights, customer service agents had to not only rebook passengers but also secure hotel reservations, meal vouchers and alternate transportation, duties that require skills most agents do not possess.

The ACSI study also found that satisfaction declines were disproportionately negative for “business travelers and other high-value customers,” with major implications for the economy. These are the most upscale segments and tend to have above-average revenue per customer and loyalty, if serviced right.

Studies have found that 60% of travelers will change brands after experiencing 1-2 bad service incidents. In the high lifetime value world of travel, one lost customer is significant lost revenue in the future.

The companies that consider customer service a cost to be managed rather than a competitive discriminator are always the first to fail in the peak months. The marketing budget goes up during peak season acquisition, however the amount of resources allocated to customer service remains the same, creating an imbalance.

This can have the opposite effect when there are failures of service. The interdependency of the travel industry means that issues with suppliers, the weather or technical systems need professional, immediate customer service responses. But guess what: When a company does not have sufficient service capacity it becomes difficult to capitalize on their expensive marketing expenditure.

Leading travel companies are implementing specific technology solutions to address peak season customer service challenges:

Instead of failed AI implementations that just led to more customer frustration, successful companies now leverage AI to assist human representatives rather than to replace them entirely. Common AI issues in travel crises involve chatbots not capable of complex flight rebooking, and automated systems offering stale information during weather disruptions. Useful implementations will equip agents with up-to-the-minute data, tips to respond, and escalation signals.

The peak season outages in 2024 show how cloud-based systems outperformed their legacy alternatives. Cloud platforms scale capacity automatically to suit demand, avoiding the system crashes traditional architectures could experience.

Today’s travelers have come to expect frictionless experiences across channels, and 72% expect brands to know their purchase history, regardless of the communication channel used. During peak season, all your platforms must integrate and you must be able to equip your reps with the total customer information at the click of a button.

Peak times normally mean an influx of international travel, so the ability to offer multilingual support is essential for success when it comes to customer service.

According to industry sources: 29% of businesses lose customers because of the lack of support for multiple languages while 70% of customers are more faithful to a company when it offers them support in their native language. Peak season stress further exacerbates these language preferences, increasing the importance of multilanguage ability even more.

Peak season customer service success is more than translation. High-stakes travel crisis-scenarios compound the cultural norms around how people expect to be interacted with, how formal an interaction they are looking for and how their problems are solved.

A success story from Southwest Airlines is a compelling example of how travel brands can tackle peak season customer experience struggles with the right technology and operational fixes.

Before 2018, Southwest had struggled to maintain customer service during peak season because of slow response times and divided communication tools. customer service teams couldn’t quickly resolve traveler issues, especially during high-volume travel periods, because systems weren’t integrated and response protocols were slow.

Southwest implemented three key changes focused on customer service improvement:

In 2018, Southwest streamlined Customer service by linking Customer-facing workgroups with its operations, reservations, and maintenance groups, which reduced lag time typically experienced during peak season.

Real Time Customer Communication: The airlines invested two billion dollars in improving the customer’s experience including:

Peak season Staff coordination Southwest formed cross-discipline teams to address customer service crises in hours rather than days. 2,000+ staff trained to handle peak season customer support escalations.

The change resulted in measurable customer service enhancements:

Southwest’s model teaches that delivering peak season customer experiences relies on integrated systems, the ability to communicate in real time and coordinate reaction teams, not just increasing staff count.

There are also practical things travel companies can do to avoid customer service failures over this peak:

Instead of scaling reactively, the best-performing companies anticipate service demand based on historical information and booking trends. This involves analyzing:

Peak season customer service is about proactive communication. Companies should implement:

Peak season success requires additional specialized training that standard customer service skills don’t cover:

When peak season customer service breaks down, the economic implications are not limited to the immediate costs of crisis management:

Travel organizations are, for the most part, pumping a lot of marketing cash into peak seasons, but the content (in a service sense) is a waste of that customer acquisition budget. If new signups hit service issues on their first attempt, the lifetime value math goes negative.

Social media magnifies peak season service breakdowns and the resulting PR nightmares endure long after the issues are resolved. Travel firms must then invest in reputation management and often price-led offers to win back customer trust, a process that tends to take several seasons.

Travel companies failing in the customer-service stakes at peak season are not a fact of life; they are the expected outcome of underlying systemic failings that get overexposed in times of high demand. An analysis of the $28 billions of industry losses in 2024 points to three defining patterns: outdated technology, insufficient staffing models and nearsighted economic priorities converge to create a perfect storm of service breakage when travelers need assistance the most.

The evidence shows that the cost of such failures spread well beyond immediate day-to-day operational disruption. With 60% of shoppers switching to other brands after bad service, and response times pushing to 24+ hours at peak times, travel providers find themselves staring down the barrel of transformation or obsolescence.

Companies that have successfully managed peak season issues share certain traits Cloud-based scalable infrastructure, proactive communication strategies, multilingual capabilities and, most importantly, a strategic view of customer service as competitive edge and not operational overhead.

Growth in the travel industry will only compound the pressure of peak season, with an anticipated 73% of bookings to be online by 2029. Travel businesses that commit to an all-encompassing customer service transformation today will gain a disproportionate share of the market advantages. Those that persist in operating with reactive, under-resourced models are setting themselves up for ever-more costly failures that accumulate and become more intractable each season.

And what comes next involves revamping the tech, making strategic investments in staff, and making fundamental changes to how travel companies think about their customer service operations. The $28 billion wake-up call of 2024 is clear: excellent peak season customer service is now mandatory your very survival in today’s travel industry may depend on it.

Travel operations analytics involves collecting and analyzing data related to travel business operations, such as resource allocation, disruption management, service delivery, and cost control. This analysis helps in making informed decisions to enhance efficiency and customer satisfaction.

Data analytics enables travel companies to optimize operations, improve customer experiences, forecast demand, manage disruptions, and reduce operational costs by providing actionable insights derived from various data sources.

External data sources encompass weather forecasts, traffic and transit information, competitor benchmarks, economic indicators, and social media reviews.

Higher CSAT boosts repeat bookings and client retention, leading to stronger long-term profitability.

Travel Automation Expert