TL; DR: In this Extensive guide, we are going to look at the features which a B2B travel portal must have for the travel agencies to operate their travel agency effectively and to reach maximum bookings in 2026. Learn how functional portal features from advanced booking engines and supplier integrations to automated commission tracking and mobile accessibility; influence your agency’s productivity and profitability. Key Takeaway: The global B2B travel market is set to reach $55.8 billion in size by 2030 at a compound annual growth of 9.6%.

A B2B travel portal is an online platform created only for travel agents and tour operators, which allows them to search / compare / book and manage travel inventory from multiple suppliers through a single platform, with wholesale rates, commission-based fees and business-class tools that most consumer booking sites do not offer.

Unlike booking sites that cater to consumers directly (booking.com, Expedia), a B2B portal links agencies, tour operators, and corporate clients to suppliers (airlines, hotels, etc.) providing real-time inventory, automated booking and policy alignment for the purpose of managing professional travel.

Market Growth: The global B2B travels market was valued at $ 31.73 billion in 2025, and is projected to reach $ 55.8 billion by 2030, growing at a compound annual growth rate of 9.6% during the forecast period.

Such explosive growth reflects the travel industry’s fundamental transition to digital platforms that bring together disparate workflows The travel agency industry’s global revenue approached $300 billion in 2025, with nearly 600,000 businesses competing in this market.

The biggest challenge that travels agencies will face in 2026 is fragmentation in their operational processes. Travel agents have hundreds of supplier systems and spend most of their time managing password related issues, logging into various platforms, etc. While constructing one multi-day itinerary, agents switch between different systems for flights, hotels, ground transport, and tours.

Digital Dominance: Online channels represented 70% of the total sector revenue in 2024 and the trend has only grown stronger in 2026 with comprehensive B2B portal software a necessity for any competitive operation.

Key Takeaway: New age B2B travel portals tackle operational chaos by streamlining supplier partnerships, automating administrative workflows and bringing a single source of truth for inventory, pricing and booking management.

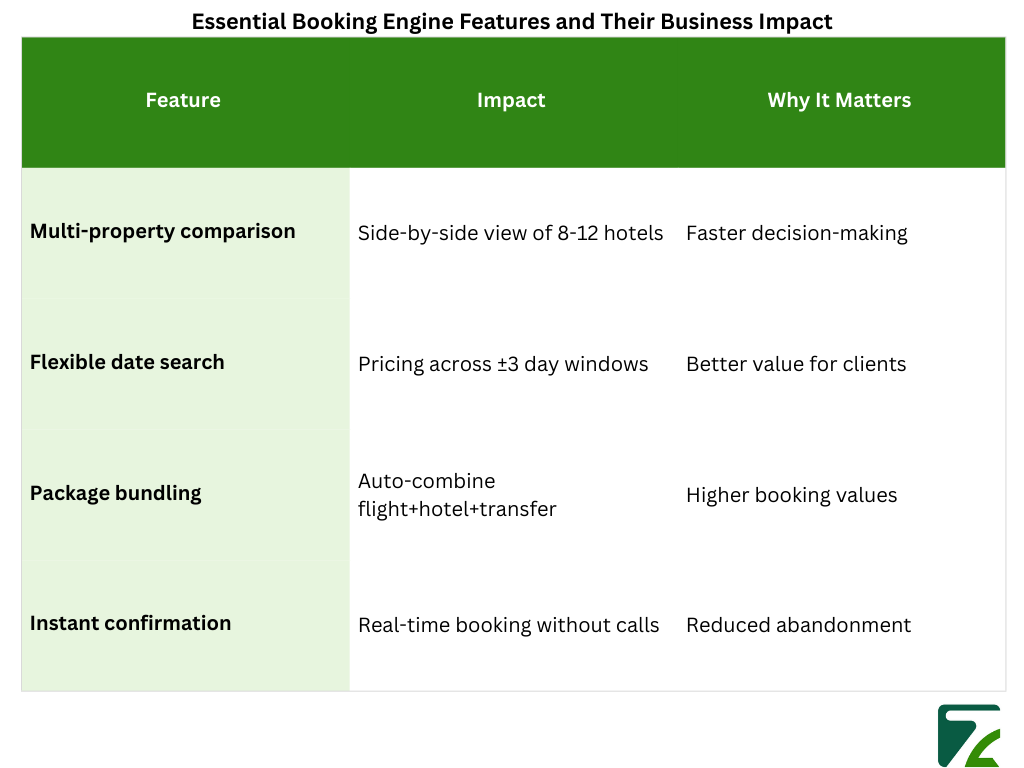

One search interface that sends simultaneous requests to multiple suppliers (for flights, hotels, ground transportation, activities) with aggregated results showing real time availability and pricing, which reduces quote preparation time from 2–3 hours to 15–20 minutes.

2024-2025 saw cloud-based platforms becoming the leading player, with more than 78% market share in the global B2B travel platform market shared across the world, highlighting a shift in the industry towards integrated, web-based solutions with continuous data synchronization, which continues to evolve in 2026.

Red Flag: Portals that offer “real-time availability” but use cached inventory that gets updated every 6 to 24 hours causes operational inertia in that agents end quoting unavailable properties leading to a complete reset of quote creation.

The more suppliers that are integrated and the more data and insight flows through the portal, the greater its value. In order to provide competitive pricing in addition to complete inventory coverage, leading portals need to provide both GDS and direct supplier API access.

In 2026, found that accommodation booking became the best segment, capturing more than 45% of the total global market share, highlighting the need for hotel inventory access.

Layer 1: GDS Connectivity (Amadeus, Sabre, Travelport)

Layer 2: Direct Hotel APIs

Layer 3: DMC & Local Operators

Layer 4: Vacation Rentals

Key Takeaway: Portals that only offer GDS access keep agencies stuck in the disconnected workflows they are meant to get rid of.

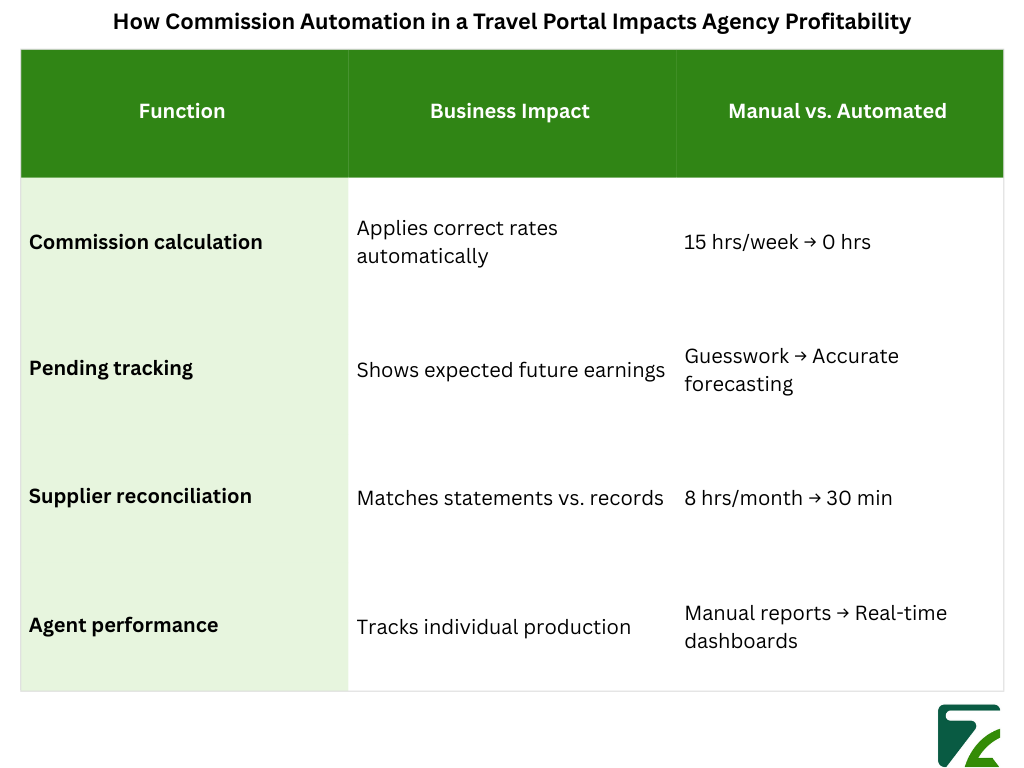

The difference between profitable and unprofitable agencies is proper commission tracking. All supplier bookings should have commissions automatically calculated, tracked and reconciled by the portals without any manual spreadsheet work.

Real Results: With 17 weeks of $1+ million commission payouts in 2024, KHM Travel Group’s investment in commission automation has resulted in a critical proof point in favor of automation by direct translation to revenue, which continues to accelerate adoption in 2026

Travel agencies would earn from 30-40 individual suppliers who all have different commission structures:

With 2026 proving a standard of commission transparency at point of sale, automated commission applications help reduce Agency Debit Memos (ADMs) by protecting agency revenue directly from costly errors.

Key Takeaway: Besides saving you time, commission automation helps you capture revenue that would have otherwise been lost due to manual processes with agencies recovering between 8-12% of commissions that otherwise went unclaimed.

Mobile functionality has gone from a nice-to-have to a must-have, allowing agents to be more productive during site inspections, client calls, and industry events, without relying on their desktops which became very apparent during the pandemic and is still prevalent today in 2026.

Three Essential Mobile Capabilities:

CRM Impact: Travel agents who implement CRM software see 23% more clients (travel booking revenue) from integrated customer management systems.

Unified Client Profiles

Preference Tracking & Application

Travel Anniversary Reminders

Communication History

Youth Surge: The percentage of 18-24-year-olds booking with travel agents jumped from 26% in 2019 to 48% in 2024, and the trend continues to climb in 2026, signifying an ongoing interest for personalized service which is what a robust CRM allows you to deliver at scale.

Key Takeaway: CRM is not an external system; it has to go hand in hand with the portal so that the agent can provide personalized service without hopping platforms.

Travel portals deal with incredibly sensitive information, such as passport numbers, payment cards, customer health, and financial data. By 2026 cyber threats are more prevalent than ever, and security failures leave agencies open to litigation and reputations ruined.

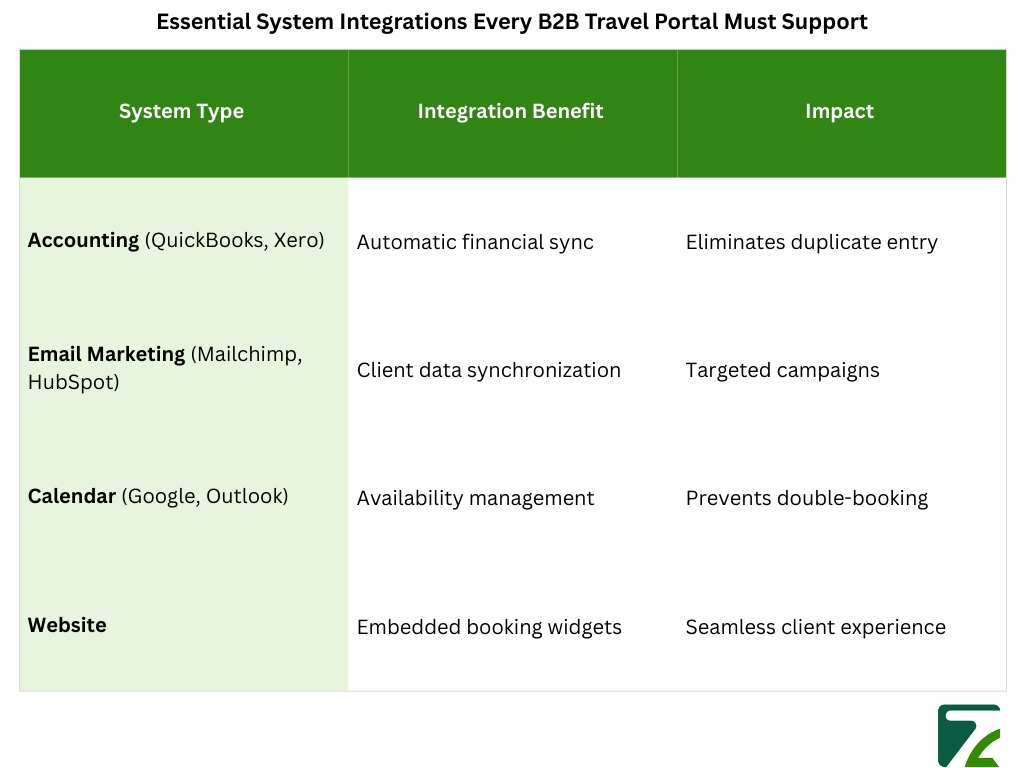

No portal operates in isolation. Depending on whether the portal integrates with existing accounting systems, email marketing and communication systems, the portal can be your new operational center or just another orphaned tool.

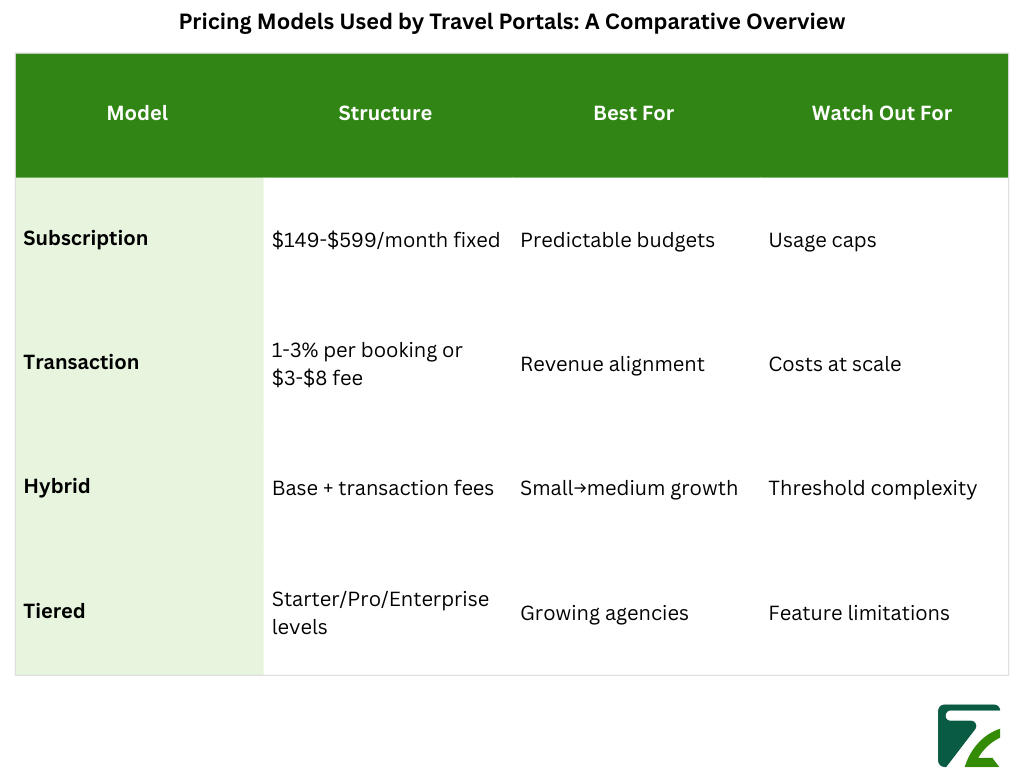

Enterprise B2B portal software pricing spans $49-$800 + per month based on agency size and available features. Extracting the true cost of ownership (including hidden costs) is key to a correct ROI assessment.

Industry Growth: The global B2B travel market was valued at $30.19 billion in 2024, expanded to $31.73 billion in 2025, and growing at 5.49% CAGR reaching $46.33 billion by 2032 continuing trend of investment into the industry through 2026 and beyond.

Compare the total annual cost of the portal against:

Market Recovery: The U.S. travel agency market exceeded 2019 values in 2024, with gross bookings continuing strong growth through 2026 demonstrating strong fundamentals supporting technology investment.

Key Takeaway: Most agencies achieve positive ROI within 4-7 months through combined time savings and revenue improvement.

Choosing a B2B travel portal is one of the most powerful technologies of your agency. Online sales for global travel and tourism services represented 70% of revenue in 2024, and this trend is gaining strength in 2026, causing companies to place a higher importance on digital platform choice to fit competitive positioning.

Employment Stability: The U.S. Bureau of Labor Statistics projects 2% employment growth for travel agents from 2024 to 2034, with approximately 7,100 annual openings indicating continued industry stability and opportunity for agencies investing in proper technology infrastructure.

Key Takeaway: The right platform transforms agency operations from fragmented and manual to unified and automated positioning you for sustainable growth in 2026’s increasingly digital travel marketplace where efficiency and personalization determine competitive success.

A GDS (Global Distribution System) like Amadeus or Sabre is primarily an airline-focused inventory system providing access to flights, major hotel chains, and car rentals through a command-based interface requiring extensive training. A B2B travel portal is a modern web-based platform that aggregates GDS content PLUS direct supplier connections, vacation rentals, tours, and activities through a user-friendly visual interface including CRM, commission tracking, and itinerary presentation that GDS systems don't provide.

Timeline by Agency Size:

Best practice: Maintain parallel operations for 2-4 weeks during transition rather than immediate cutover.

Yes. Entry-level platforms start at $49-$149 monthly with transaction-based pricing scaling with volume. Many providers offer freemium models zero cost to start, paying only transaction fees until reaching volume thresholds. The median annual wage for travel agents was $48,450 in May 2024, making even premium portals affordable with efficiency gains.

Yes, but portal selection requires more due diligence. Luxury agencies need access to luxury hotel collections (Virtuoso, Signature) and villa charters. Adventure agencies need extensive tour operator and DMC connections. Verify the portal serves agencies in your niche successfully and confirm supplier coverage in your specialty markets before committing.

Standard support: Email response 4-24 hours, phone during business hours

Premium support: 1-2 hour email response, 24/7 phone access, dedicated account managers

Industry benchmark: Leading providers resolve 75%+ of issues on first contact with average email response under 4 hours.

Travel Automation Expert