Rate parity sounds simple: maintain the same price for hotel rooms across all booking channels. If you have a $200 room on your site, it remains a $200 room on Booking. com, as well as Expedia and phone calls to the hotel.

But to OTAs, this policy is about much more than price uniformity. It’s the financial underpinning of the business model. When a guest books through an OTA, the platform levies a 14 to 30 percent commission. If hotels give discounts on direct channels, those bookings are taken away from OTAs completely. Rate parity ensures that OTAs remain in the pricing gateway.

Realizing this difference explains why OTAs are so fanatical about monitoring and enforcement. This has nothing to do with fairness or consumer protection. It is also about preserving the commission revenue that pays for platform operations, marketing, development of technology and shareholder returns.

Three strategic imperatives drive rate parity monitoring.

The math is straightforward. A $200 room at 25% commission is worth $50 in OTA revenue. If the hotel cuts $180 direct, that’s zero dollars for the OTA on that booking. Rate parity breaches cost billions in potential revenue across millions of bookings each year.

In Europe, hospitality market analysis from Horwath HTL reveals that OTAs are responsible for 70 to 77 percent of all hotel bookings. Such market leadership relies on rate parity enforcement. Without the presence of those sites, hotels would discount direct bookings more aggressively, and that would in turn compress commission rates throughout the industry. The business model becomes unviable.

With no rate parity monitoring, markets would collapse in short order. Big hotel chains would charge less for direct bookings than smaller rivals. Metasearch sites would show vastly different prices. Visitors would be in a never-ending state of confusion, and switching costs would rise.

For OTAs, rate parity control is the solution for this chaos prevention. It establishes reliable operating environments where prices are stable. This stable base allows investment in technology, marketing, and growth.

According to market share analysis,Booking. com dominates 71% of the European hotel booking market and 69.3% worldwide. This control also prevails due to rate parity enforcement, which keeps hotels dependent. Hotels cannot compete on price, which forces guests to use Booking as the primary pricing reference point.

Independent OTAs with smaller customer bases cannot keep the monitoring infrastructure; there is a need enforcing these regulations. That is a competitive moat that strengthens for Booking’s position

OTA monitoring operates through three interconnected systems working continuously.

OTAs use complex systems to search for price discrepancies across the web. These bots monitor (in real-time) hotel websites, OTA sites/competitive platforms, meta search engines, and direct booking channels.

Intentional markdowns differ from mere transient errors by machine learning. Automated alerts are activated within minutes of detection of a violation. Booking. com does this at massive scale, watching

Metasearch (Google Hotel Ads, TripAdvisor, Kayak) drives over 30% of OTA traffic. OTAs pay close attention to these channels as well, because visibility translates directly into bookings.

Sometimes, when a hotel looks cheaper on metasearch than on the OTA site, companies’ automated systems detect it straight away. This live monitoring on all key meta-search networks brings instant proof of price disparity.

OTA’S are constantly comparing rates across rival platforms. These systems check that hotels maintain consistency between Booking.com, Expedia, Agoda, and other dominants.

Strategic pricing actions are indicated by the comparison data. If a hotel is in parity with Booking but discounted on Expedia, OTA systems quickly identify this trend. This record is then used as evidence for enforcement purposes

Enforcement mechanisms transformed in 2024, marking a critical strategic shift in how OTAs maintain pricing control.

OTA-hotel agreements included clear rate parity provisions prior to 2024. The penalties for loss of rate integrity were direct: higher commissions, cancelation, delisting and removal from promotional placement or margin shaving (where OTA undercuts the hotel’s direct rate).

This system of contracts served us well for many years. Hotels either maintained parity or faced immediate consequences. It was specific, enforceable, and extremely effective but legally fragile.

Explicit rate parity clauses were left prohibited under the EU Digital Markets Act in March 2024. Booking. com, referred to as a “gatekeeper,” may no longer rely on contractual enforcement in Europe.

OTAs modified through algorithm enforcement relocation. There are now more than 900 variables for hotel ranking algorithms, including rate consistency. Parity-keeping hotels move up the rankings. Hotels caught breaking parity are algorithmically downranked.

This programmatic approach achieves the exact same business result but does so in a more defensible manner. OTAs say they are optimizing algorithms, not demanding parity. The legal distinction is crucial, even if in practice the results will be the same.

In July 2024, Spain fined Booking.com €400 million for algorithmic rate parity enforcement. Evidence showed that Booking.com systematically demoted the ranking of hotels on Nustay listings (which belonged to its subsidiary) when these offered a lower fare than Booking. com.

Hausfeld’s analysis of competition law, said that this penalty demonstrated how even algorithmic enforcement faces regulatory scrutiny. But Booking is keeping enforcement in place, indicating that this cost is acceptable compared to revenue losses from unmonitored violations.

Here’s the paradox that defines the modern rate parity dynamic: Hotels in Europe can legally break parity under DMA, yet most maintain it voluntarily. Why?

In Europe, about 70 to 77% of bookings for hotels are made through OTAs. When OTA systems choose to lower the visibility of the property due to inconsistency with pricing, the impact can be significant.

Suppose a hotel that practices parity gets $5,000 a day in OTA bookings. If the hotel then decides to discount by 10% in a bid to get direct bookings, then OTA algorithms will demote the hotel resulting in a decrease in OTA bookings of $2,000 a day.

And in direct bookings the hotel will get $500, but the loss of revenue from OTA will amount to $3,000 each day. The math is ruthless. Even though it is legally applicable, it becomes economically rational because of rate parity.

According to research by the hospitality industry company Hotel Buddy, Hotels with better direct rates see less OTA visibility. Metasearch platforms penalize pricing inconsistency. Operationally, parity is still enforced over the market mechanisms even when it has been legislatively prohibited.

The new rule might have relieved hotels from a legal obligation, but it did nothing to change economic reality. The enforcement mechanism that counts is still OTA visibility dependence. It is as if the law changed and the market did not.

Rate parity regulations vary dramatically by market, creating both complexity and strategic opportunity for global OTAs.

It was also under the EUs Digital Markets Act that rate parity clauses would be outlawed for designated Gatekeepers. As documented in EU regulatory documents, DMA Article 5(3) expressly prohibited price-parity clauses and, to quote directly “any measures having an equivalent effect.”

This is meant to apply both contractual and algorithmic enforcement. Regulators in the EU are taking legal action against breaches. The Spain fine creates a €400 million blueprint for enforcement with serious consequences.

The US is not banning them outright, but the FTC closely monitors OTA practices for antitrust violations. The same is true of Amazon’s metasearch practices. You’ll see rate parity bans in 2-3 years as US regulators follow EU precedent.

India outlawed rate parity for OTAs 100% in 2024. China permits unchecked enforcement with few restraints. Southeast Asia has minimal restrictions.

This fragmentation creates strategic opportunities. Emerging OTAs take advantage of uncontrolled areas in which enforcement is still feasible. When markets mature and regulations tighten, those windows close

Not all OTAs rely heavily on traditional enforcement. Emerging competitors succeed through alternative business models.

Ctrip books at the 4.4 percent commission about one-third of Booking’s 14.3 percent. This efficiency-based model can accommodate market shares without aggressive enforcement. Hotels will agree to lower commissions because Ctrip’s technology and scale means the distribution cost is much cheaper.

There, we see that one doesn’t need affirmative compulsion to ensure commission protection. Better operations make up for weaker control. Efficiency becomes the moat, rather than price control.

Some OTAs package flights, hotels and cars to completely ‘white label’ the room rate. In dynamic packaging, the $200 room now contributes to a $400 package (flight + hotel + transfers). Rate parity doesn’t mean anything when there is no price transparency.

This is the new adaptation to regulation pressure ignore parity instead of vigorously enforcing it. It’s strategic opacity, not pricing control.

OTAs evolve towards advertising models where hotels pay for placement. Advertising margins are 60-80 percent, compared to commission rates of 14-30 percent.

When ads are the main source of revenue, parity regulation is no longer vital. Visibility comes from advertising spend, not pricing stability. This changes the business model dynamics altogether.

OTA executives should evaluate rate parity enforcement through a rigorous ROI lens.

Calculate Your Enforcement ROI:

Step 1: Revenue Protected Annually

= (Average commission rate) × (Total GTV) × (% of bookings lost to direct discount)

= 15% × $50B × 5% = $375M annual protection

Step 2: Enforcement Cost

= (Monitoring systems) + (Legal/compliance staff) + (Expected penalties/fines)

= $50M systems + $25M staff + $100M expected fines = $175M annual cost

Step 3: Calculate ROI

= ($375M protection – $175M cost) / $175M cost

= 114% annual ROI

At this ROI level, rate parity enforcement remains economically justified despite regulatory risks.

Importantly, OTA strategists should envision more than one future. Commission pressure, regulatory crackdown and tech invasion set up the need for scenario plans.

Regulation gets tighter, but OTAs adjust well. Algorithmic enforcement becomes an industry standard. Commission rates compress down 1 to 2 percent a year. Advertising revenue becomes 25-30 percent of total revenue. OTAs continue to be all about rate parity through 2030.

OTA Action: Drive advertising revenue growth. Pour money into algorithm defense (legal position). Prepare for more fine expectations ($250MM+ precedent).

Regulatory pressure is relaxing as enforcement is hard to implement. Contractual parity clauses make a quiet reappearance in non-EU territories. Commission rates stabilize as the new OTAs settle down. Rate parity enforcement is also more efficient and less risky.

OTA Actions: Maintain current enforcement. Look to continue re-entry on the basis of contractual parity in markets outside the EU. Monitor regulatory mood shifts closely.

Global and aggressive regulation is aimed at algorithmic policing in particular. Huge fines ($500M+) are treated as business costs. Commission rates compressed to industry average 8-10 percent. OTAs pushed into wholesale advertising/loyalty players. Enforcement of Rate Parity is economically unsustainable.

OTA Actions: Start rapid transformation into an advertising first model. Develop loyalty/experiences revenue beyond bookings. Invest in direct consumer relationships. Brace yourself for a business model change.

Have a backup plan for each regulatory outcome.

If rules are strengthened even more (Probability: 65% by 2027):

If commission pressure rises (Probability: 75% by 2026):

If algorithmic enforcement becomes unsustainable (Probability: 40% by 2028):

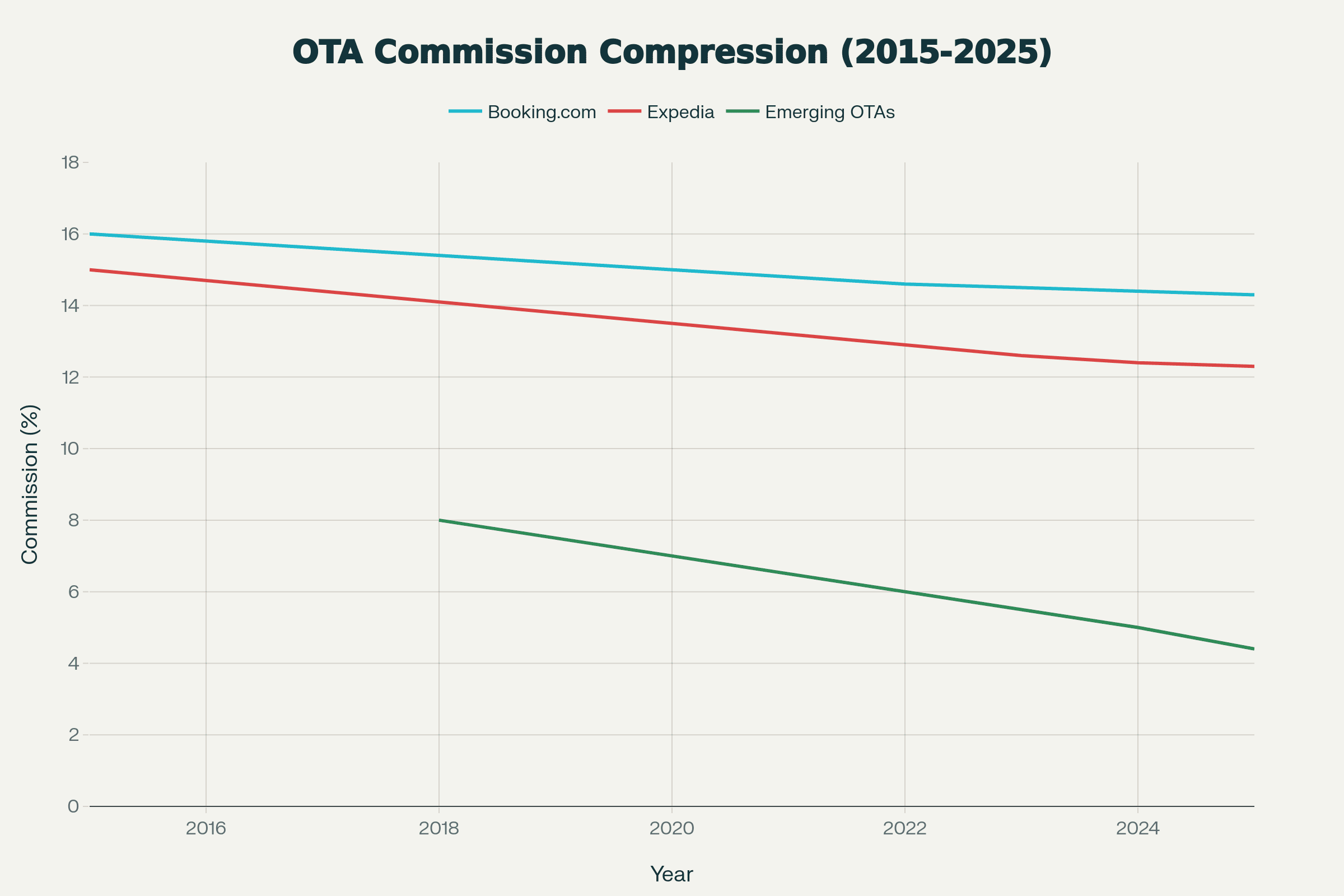

OTAs’ Commission Rate Compression Trend (2015-2025) demonstrate the decline in commission rates for all OTA segments, with emerging OTAs operating at significantly lower rates

The long-term trend is unmistakable. Commission rates are being squeezed in all travel segments on OTAs.

Booking. com rates have dropped from 16% (2015) to 14.3% (2025). Expedia’s rates dropped from 15 percent to 12.3 percent. Upstart OTAs came in at 8% (2018) and decreased to 4.4% by 2025.

This squeeze shows competition exerting pressure to diversify the business model. Rate parity imposition is economically sound but cannot avoid structural commission reduction.

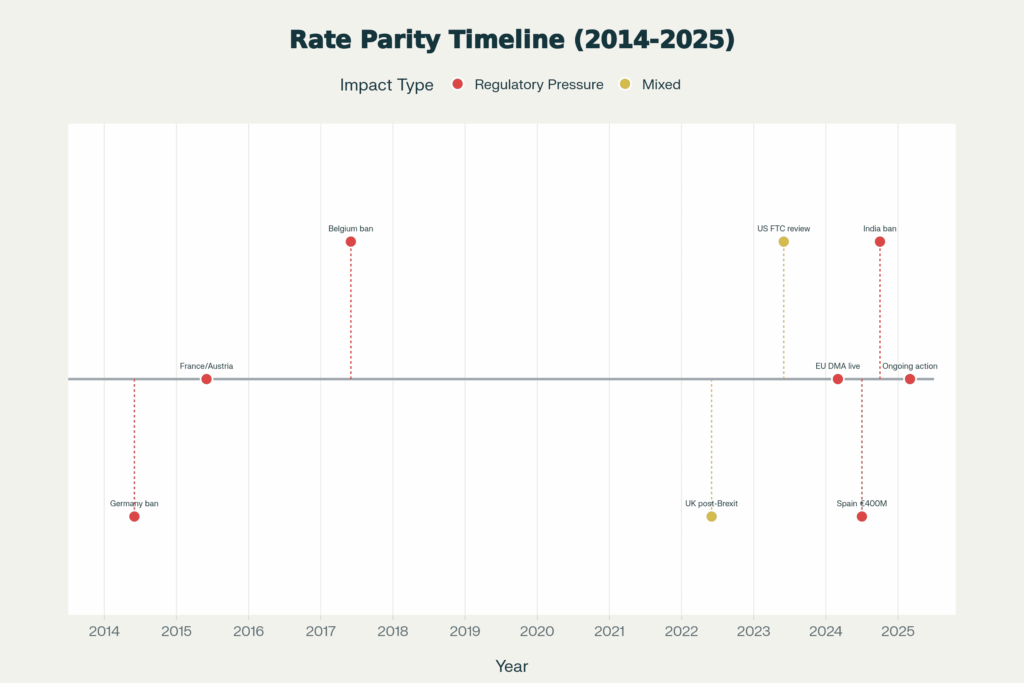

Rate Parity Regulatory Timeline (2014-2025) Here are the crucial touchpoints which highlight accelerating regulatory pressure on rate parity enforcement globally

The regulatory assault on rate parity is systematic and accelerating globally.

Germany banned parity in 2014. France and Austria came in 2015. Belgium in 2017. And in 2024, Spain fined the company €400 million, and India went a step further with its outright ban. And the pattern is clear: Regulatory tightening accelerates over time, spreading from the EU to other regions.

This history demonstrates to OTAs that regulatory risk is not declining. Time for profitable enforcement is running out.

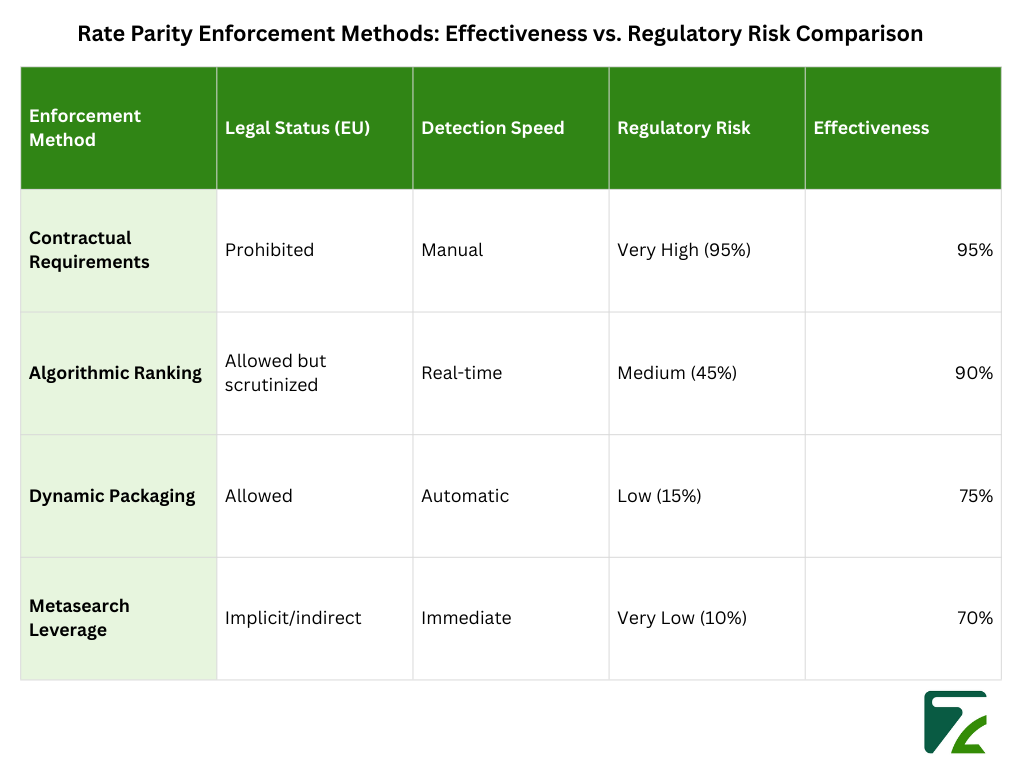

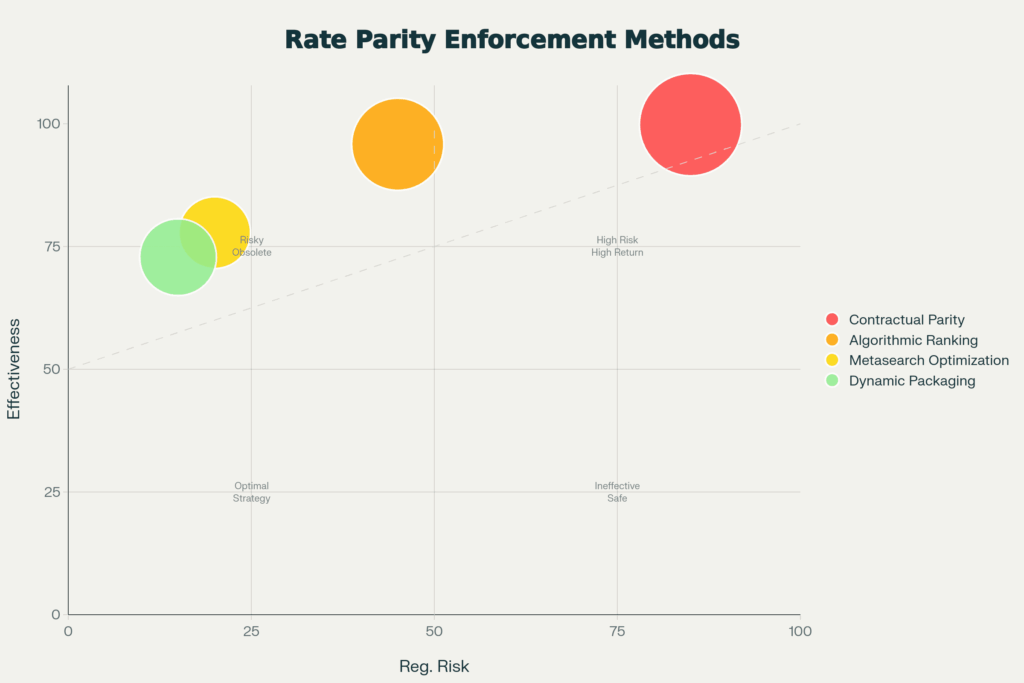

Methods of enforcing rate parity: Effectiveness vs Regulatory risk .

Bubble chart displaying tradeoff between enforcement effectiveness and regulatory / legality exposure

The trade-off between enforcement efficacy and regulatory risk is blunt.

It’s a clear strategic trade-off between effectiveness of enforcement and risk of regulation.

Contractual parity was 92 percent successful but had a regulatory risk of 85 percent (prohibited, now). When regulatory risk is 45 percent (then standard), an effectiveness of 88 percent is reached by the algorithmic ranking. Dynamic packaging and metasearch optimization are 70-75 percent effective but carry a 15-20 percent regulatory risk.

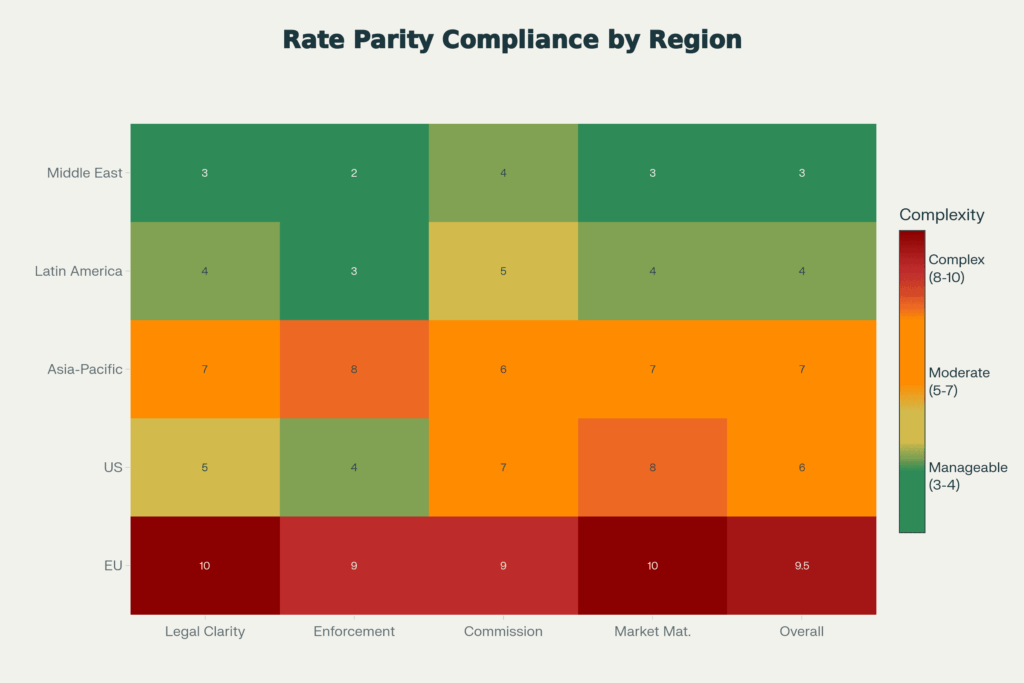

Rate Parity Compliance Complexity by Region Heat map shows regional regulation, enforcement risk and market conditions

Complexities for compliance differ significantly among regions and must be addressed through more than one OTA approach.

The EU is the most complex (9.5/10 overall). Asia-Pacific is hot (7). The US is moderate (6 out of 10). Latin America is at a low end (4 out of 10). MENA is the lowest (3 out of 10).

This heat map assists the OTAs allocate compliance resources and concentrate their market focus wisely. High-complexity areas need different strategies than low-complexity market strategies.

Rate parity is changing,not disappearing. The OTAs will remain algorithmic due to economic pressure of enforcement. Protection for the commission base is still core to business models. Market stability is still needed to be able to scale operations.

The message is simple for OTA strategists: Use the model presented to form your own rate parity enforcement ROI. Develop scenario plans for regulatory tightening. Start moving other forms of revenue now. The window for adaptation is narrowing.

The future will be the domain of OTAs that successfully manage this complexity those who combine regulatory compliance with profitability, prepare for various scenarios and create revenue models not based on nothing more than commission.”

Rate parity itself could change or disappear. But the tactical challenges it poses managing hotel dependencies, protecting margin, adapting to regulation will shape OTA strategy for the next 10 years.

OTAs enforce rate parity to protect their commission-based revenue model and prevent hotels from undercutting their platforms with lower direct prices. Without rate parity, OTAs would lose billions in booking revenue as guests would always choose cheaper direct channels.

OTAs use automated bots and machine learning algorithms that continuously scan hotel websites, competitor platforms, and metasearch engines for pricing discrepancies. These systems can detect rate parity violations within minutes and trigger immediate enforcement actions.

Explicit contractual rate parity clauses were banned in the EU under the Digital Markets Act (March 2024), but OTAs shifted to algorithmic enforcement methods. They now incorporate pricing consistency into ranking algorithms, which is more difficult to prosecute but achieves the same business outcome.

Rate parity monitoring protects OTA commission rates (typically 15-30%) by preventing hotels from competing on price through direct channels. Without enforcement, hotels would discount aggressively on direct bookings, forcing OTAs to lower commission rates to remain competitive.

AI enables personalized pricing where different guests see different rates based on behavior and preferences, making uniform rate parity increasingly difficult to maintain. Advanced machine learning also improves detection accuracy, identifying intentional violations versus temporary pricing errors with greater precision.

Travel Automation Expert