In the competitive travel environment, with increasing costs to acquire customers and market becoming increasingly crowded, recognizing and dealing with customer churn has never been more of a key business attribute for travel agencies. Customer churn is essentially the percentage of people who no longer do business with your travel agency over a given period. By companies in the travel space where they are already working on thin margins with seasonality pressure, any incremental rise in churn rate can really nail them and affect not only their short-term P&L but also long-term survival.

Unlike subscription services where churn is directly observed through canceled memberships, it is a challenge to identify and measure customer loss in the travel agency business. There is a difference between voluntary churn (where costumers decide to leave because they choose competitors) and involuntary churn (in which the customers have a passive disconnection that is a consequence of altering travel patterns), and this area needs its own insights and strategies, in coherence with travel industry’s booking cycles & customer journey .

The math of customer churn in travel agencies has an interesting story. Studies from Harvard Business Review indicate that the cost of acquiring a new customer can be 5 to 25 times more than to keep an existing one. This is especially challenging for travel businesses, who even in the best of cases would be competing with some category of paid advertising where cost-per-click can run between $5-10 or more and conversion rates might peak at 2-3%.

Think about lifetime value: A loyal guest who books twice a year, at $2,500 per transaction on average, brings in $5,000 in revenue each year. That’s so in an industry where the common commission rate is 10-15%, which can mean $500-750 in gross profit per customer per year. Only 20 of these customers slipping away costs $10,000-$15,000 loss in commission revenue, and that too before you count the downstream impact they have on your business with lost referrals and reduced brand advocacy.

Travel companies have their own churn characteristics associated with seasonal booking behavior. Compared to on-going relationship types of service purchase, travel purchase is episodic and thus it is hard to differentiate the dormant with churned. The average American goes on 1.5 leisure trips a year, leaving long stretches of time in between purchase occasions for competitors to win mindshare and wallet share.

For example, think of a mid-sized OTA catering to business travel. They looked at their customer database and learned that repeat business was down 20% year over year, meaning they were leaving $2.3 million in revenue on the table. The root cause? Poor post-booking interaction and limited if not zero proactive communication in event of travel disruptions. What they found was those competitors providing up-to-the-minute flight status and customized rebooking capabilities had been picking off their highest-value customers, a clear case where operational deficiencies are the root cause of customer churn.

Knowing your churn rate starts with tracking it correctly. A general formula for calculating the monthly churn rate in travel agencies:

Monthly Churn Rate = (Customers Lost in Month / Total Customers at Month Start) × 100

But because travel is purchased episodically, these types of annual cohort-based retention measures are often more informative:

Annual Retention Rate = (Customers Who Booked in Year 2 / Customers Who Booked in Year 1) × 100

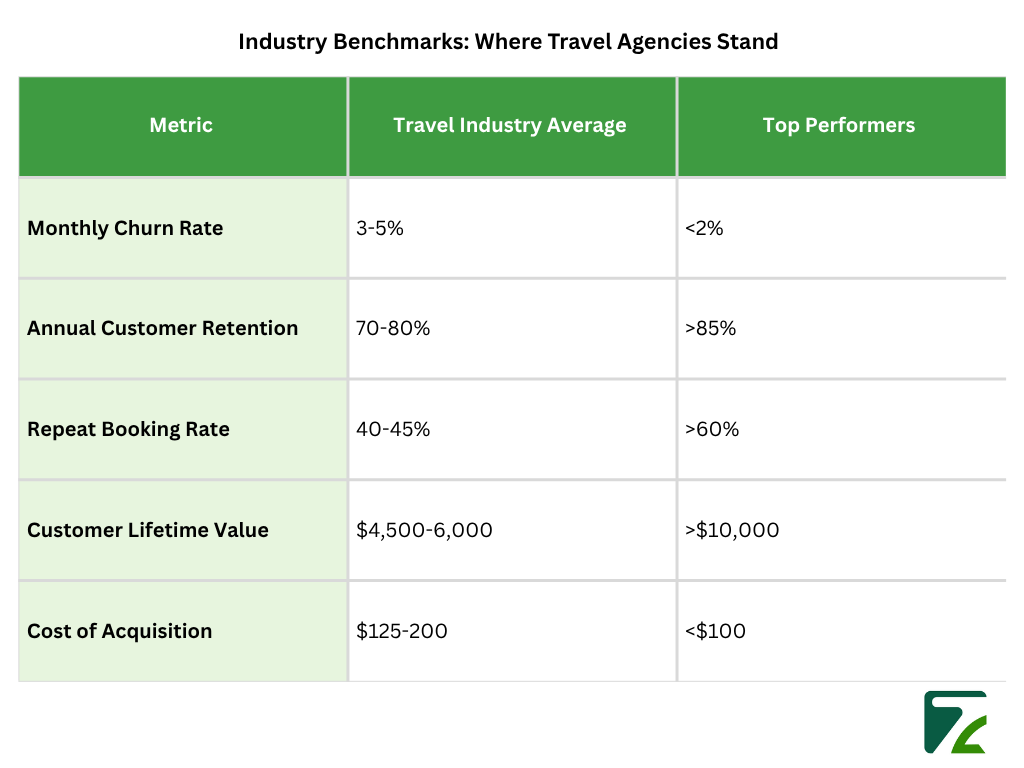

Cohort analysis indicates that customer retention strongly depends on the acquisition channel and type of initial booking.According to Skift Research, loyalty program-acquired customers have 25% greater retention than those acquired directly through paid search that’s a valuable piece of insight about the acquisition strategy and how it is key in managing long term churn.

The time between booking and travel is a retention hotspot that many agencies are wasting. Studies show that 67% of customers want more proactive communication on their upcoming trip, yet many agencies only communicate transactional confirmations. This gap in engagement opens the door to competitors poaching it, and also limits the emotional connection needed for repeat purchases.

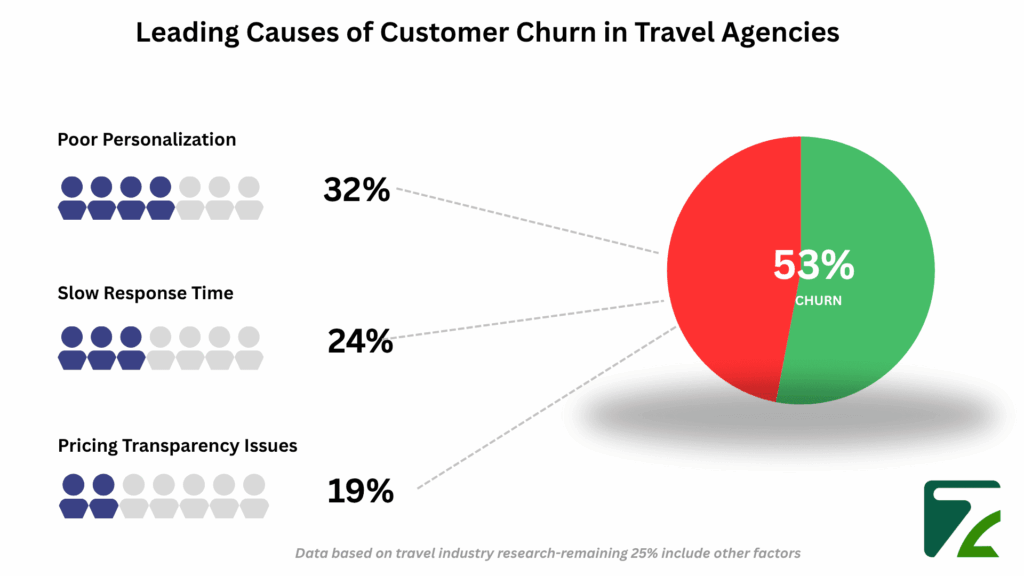

Mass market, one-size-fits-all marketing messages no longer connect with today’s travelers who demand personalization. Travel companies that are suffering from a high customer churn often don’t have the necessary data infrastructure to track preferences, previous destinations, and booking history. Without this intelligence, the cross-sell and upsell disappear, and customers see no distinguishing value over other companies who have similar inventory at a similar price.

Technical challenges exacerbate churn risk in our mobile-first world. Google’s findings indicate that 53% of mobile users leave a site if it takes longer than three seconds to load. For travel companies, lagging booking engines, complex check-out flows and non-optimized mobile shopping all offer a straight line to the higher churn rate. Missed payments, mistakes in booking, and slow responses to customer inquiries serve to reduce trust and also business for competitors.

The use of automatic communication processes significantly increases customer retention. The successful agencies run multi-touch campaigns that featured:

Point-based systems have worked well for airlines and hotels, but travel agencies require different strategies. The best OTA loyalty programs emphasize experiences over transactions. Booking. com’s Genius program, where members receive exclusive discounts and other benefits according to the number of properties booked, shows that they have a retention rate for members which is 15% higher than those who are not.

Some of the most successful travel agency loyalty program options include:

Contemporary travelers search on mobile, compare on tablets and frequently close via desktop. Divergent experiences between devices create friction that increases customer churn. Agencies need to be able to seamlessly pass users through devices, keeping them in the same cart, search history and personal preference no matter what device they are using. Strong omnichannel companies keep customers 89% of the time, as compared to 33% of the time for weak ones, according to data from Adobe Analytics.

Modern churn prediction leverages machine learning algorithms analyzing multiple data inputs:

Key Variables for Travel Agency Churn Models:

These models make it possible to intervene before a customer turns away and conduct retention campaigns at specific high-risk segments. According to Bain & Company research, companies that leverage predictive analytics for churn prevention experience 5-10% higher retention rates.

The following steps help determine retention gaps:

It motivates such investments, of course, to have a sense for the financial consequence of decreasing customer churn: a phenomenon that should not necessarily scale linearly with revenue. Consider this calculation framework:

Annual Revenue Lost to Churn = (Number of Customers × Churn Rate × Average Customer Value)

For example, if you have a travel company with 10,000 customers, charge $500 per customer and have 5% monthly churn rate:

Monthly Revenue Lost = 10,000 × 0.05 × $500 = $250,000

Annual Revenue Lost = $3,000,000

This lowers churn just 1 %(from 5% to 4%), and results:

Monthly Savings = 10,000 × 0.01 × $500 = $50,000

Annual Savings = $600,000

This number doesn’t include things like better referrals, higher lifetime value, or less acquisition costs making the actual improvement much larger.

One of the most significant challenges and opportunities for travel agencies is customer churn. Where episodic travel buying and fierce competition lead to distinct tactics to retain existing customers, agencies that strategically approach churn with data-driven business practices, customized engagement and operational prowess can embed winning strategies into their businesses.

It will be up to you to listen and learn about your own churn patterns, set up a measurement framework that is sufficiently robust, and design service that transcends simple transactions. Those agencies that see customer retention as a strategic necessity, and not simply an operational KPI, will flourish in an ever more commoditized world.

Begin by quantifying your current churn and listing your top three churn drivers. Execute a single retention initiative this quarter and source its results. After all, in the low-margin travel business, where competition is fierce, retaining the customers you have is every bit as important as acquiring new ones. Agencies that can master the science side of retention, and also be artists about it, will thrive in hospitality as travel continues to change.

Customer churn refers to the percentage of customers who stop booking or engaging with your travel agency over a specific period. It includes both voluntary churn (choosing competitors) and involuntary churn (passive disengagement).

Churn directly impacts revenue, as acquiring new customers costs 5–25x more than retaining existing ones. Even a small increase in churn can result in significant lost commissions, referrals, and brand advocacy.

Key drivers include poor post-booking engagement, lack of personalized communication, technical friction in booking platforms, and inconsistent experiences across devices.

Travel agencies can calculate churn with formulas like Monthly Churn Rate and Annual Retention Rate. Cohort analysis and tracking booking frequency, repeat bookings, and customer service interactions provide deeper insights.

Effective strategies include automated reconfirmation and proactive messaging, loyalty programs with experiential benefits, consistent cross-device booking experiences, and predictive analytics to target at-risk customers.

Travel Automation Expert