GST Accounting Unveiled: An Expert’s Guide with Real-Life, Simple Examples

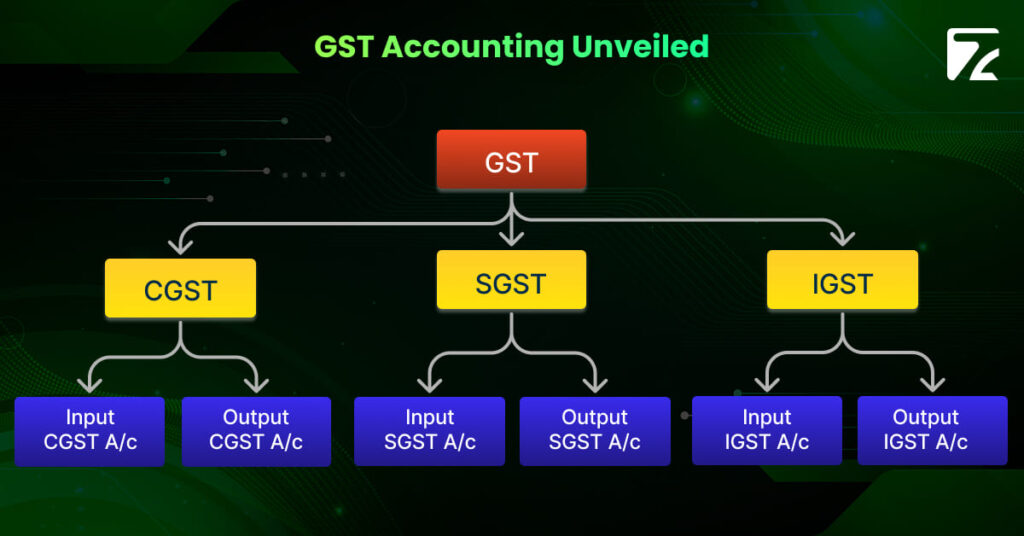

GST Accounting Unveiled: An Expert’s Guide with Real-Life, Simple Examples Hey there! If you’re feeling overwhelmed by the complexities of Goods and Services Tax (GST) accounting, you’re not alone. As a GST expert who’s worked with businesses of all sizes, I’ve seen firsthand how confusing it can be. But don’t worry—I’m here to break it down for you in simple, relatable terms, complete with detailed, easy-to-understand examples. Let’s dive in! Understanding GST: A Quick Recap Before we jump into accounting specifics, let’s quickly revisit what GST is all about. What is GST? GST is a comprehensive indirect tax levied on the manufacture, sale, and consumption of goods and services across India. It replaced multiple indirect taxes like VAT, service tax, and excise duty, unifying them under a single system. Key Features: Destination-Based Tax: GST is charged where the goods or services are consumed, not where they’re produced. Dual Structure: Comprises Central GST (CGST) and State GST (SGST) for transactions within a state, and Integrated GST (IGST) for inter-state transactions. Eliminates Cascading Taxes: With the Input Tax Credit mechanism, GST avoids the tax-on-tax scenario. The Basics of GST Accounting GST accounting involves recording all GST-related transactions accurately to ensure compliance and ease of filing returns. Essential Components: GSTIN: Your unique GST Identification Number. Think of it as your business’s tax fingerprint. Tax Invoices: Must include details like GSTIN, invoice number, date, value, tax rate, and amount. Books of Accounts: Legally, you need to maintain these for at least six years. Why is it Important? Imagine trying to assemble furniture without instructions—frustrating, right? Similarly, without proper GST accounting, you risk non-compliance, penalties, and unnecessary stress. Understanding the GST return filing and types of GST returns is crucial to stay compliant. Demystifying Input Tax Credit (ITC) What is ITC? Input Tax Credit allows businesses to reduce the tax they’ve already paid on purchases (inputs) from the tax liability on their sales (outputs). It’s like getting credit for taxes you’ve already paid. How Does ITC Work? Eligibility: You can claim ITC if the goods or services purchased are used for business purposes and are not exempted under GST. Conditions to Claim ITC: You have a valid tax invoice or debit note. You’ve received the goods or services. The supplier has deposited the GST with the government. You’ve filed the necessary GST returns. Detailed, Simple Example: Let’s say you own a small business called “Sunny’s Stationery” that sells office supplies. Purchases: You buy pens and notebooks from a wholesaler for ₹50,000. The GST rate on these items is 12%. GST Paid on Purchase: ₹50,000 x 12% = ₹6,000. Total Amount Paid to Supplier: ₹50,000 + ₹6,000 = ₹56,000. Sales: You sell the stationery items to customers for ₹80,000. The GST rate is the same at 12%. GST Collected on Sales: ₹80,000 x 12% = ₹9,600. Total Amount Collected from Customers: ₹80,000 + ₹9,600 = ₹89,600. Calculating Net GST Payable: GST Liability (Output GST): ₹9,600. Minus Input Tax Credit (GST you already paid): ₹6,000. Net GST Payable to Government: ₹9,600 – ₹6,000 = ₹3,600. So, instead of paying the full ₹9,600 in GST, you only need to pay ₹3,600 thanks to ITC! Recording GST Transactions: Step-by-Step Examples Proper accounting entries are crucial. Let’s go through common transactions with detailed, step-by-step examples. a. Recording Purchases Scenario: Your business, “Green Garden Supplies,” purchases fertilizers from a supplier. Purchase Amount (excluding GST): ₹20,000. GST Rate: 5% (CGST 2.5% + SGST 2.5%). Calculations: CGST Amount: ₹20,000 x 2.5% = ₹500. SGST Amount: ₹20,000 x 2.5% = ₹500. Total GST Paid: ₹500 + ₹500 = ₹1,000. Total Amount Payable to Supplier: ₹20,000 + ₹1,000 = ₹21,000. ACCOUNT DEBIT (₹) CREDIT (₹) Purchases Account 20,000 Input CGST Account 500 Input SGST Account 500 To Supplier Account 21,000 Explanation: Purchases Account (Debit): Increases your assets (inventory). Input CGST & SGST (Debit): Records the GST paid, which is claimable as ITC. Supplier Account (Credit): Increases your liability to pay the supplier. b. Recording Sales Scenario: Green Garden Supplies sells gardening tools to a customer. Sale Amount (excluding GST): ₹30,000. GST Rate: 18% (CGST 9% + SGST 9%). Calculations: CGST Amount: ₹30,000 x 9% = ₹2,700. SGST Amount: ₹30,000 x 9% = ₹2,700. Total GST Collected: ₹2,700 + ₹2,700 = ₹5,400. Total Amount Receivable from Customer: ₹30,000 + ₹5,400 = ₹35,400. ACCOUNT DEBIT (₹) CREDIT (₹) Customer Account 35,400 To Sales Account 30,000 To Output CGST Account 2,700 To Output SGST Account 2,700 Explanation: Customer Account (Debit): Increases the amount owed to you by the customer. Sales Account (Credit): Increases your revenue. Output CGST & SGST (Credit): Records the GST collected, which needs to be paid to the government. c. Payment to Supplier Scenario: You pay your supplier the amount owed for the fertilizers. Journal Entry: ACCOUNT DEBIT (₹) CREDIT (₹) Supplier Account 21,000 To Bank Account 21,000 Explanation: Supplier Account (Debit): Decreases your liability to the supplier. Bank Account (Credit): Decreases your cash/bank balance. d. Receiving Payment from Customer Scenario: Your customer pays you for the gardening tools. Journal Entry: ACCOUNT DEBIT (₹) CREDIT (₹) Bank Account 35,400 To Customer Account 35,400 Explanation: Bank Account (Debit): Increases your cash/bank balance. Customer Account (Credit): Decreases the amount the customer owes you. e. Calculating Net GST Payable Totals from Above Transactions: Output GST (from sales): Output CGST: ₹2,700 Output SGST: ₹2,700 Input GST (from purchases): Input CGST: ₹500 Input SGST: ₹500 Net GST Payable: Net CGST Payable: Output CGST – Input CGST = ₹2,700 – ₹500 = ₹2,200 Net SGST Payable: Output SGST – Input SGST = ₹2,700 – ₹500 = ₹2,200 Total GST Payable: ₹2,200 (CGST) + ₹2,200 (SGST) = ₹4,400 f. Paying GST to the Government ACCOUNT DEBIT (₹) CREDIT (₹) Output CGST Account 2,700 Output SGST Account 2,700 To Input CGST Account 500 To Input SGST Account 500 To Bank Account 4,400 Explanation: Output Tax Accounts (Debit): Reduces your liability as you pay the tax. Input Tax Accounts (Credit): Adjusts for the ITC claimed. Bank Account (Credit): Decreases your cash/bank balance as you pay the GST. Simplified Explanation: You’re paying